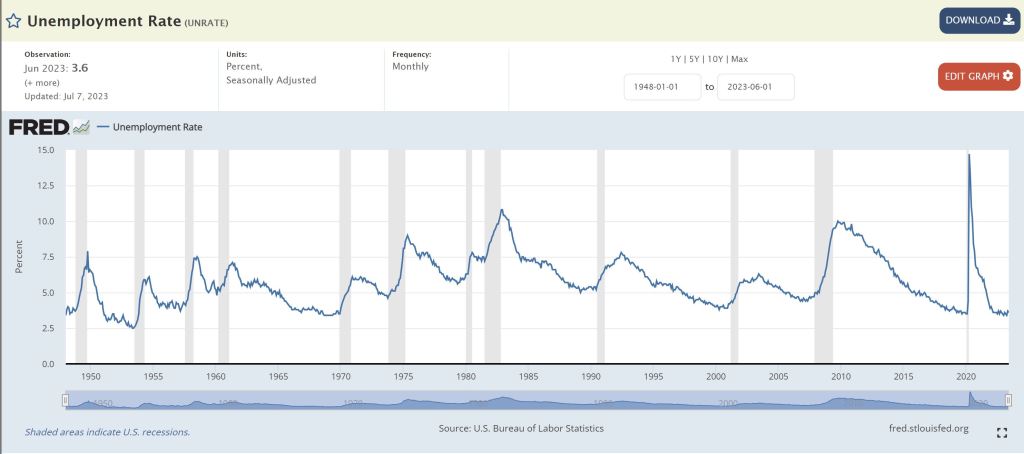

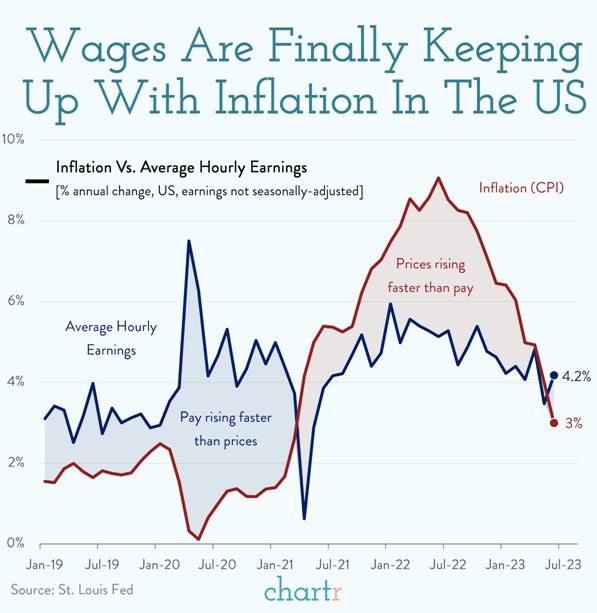

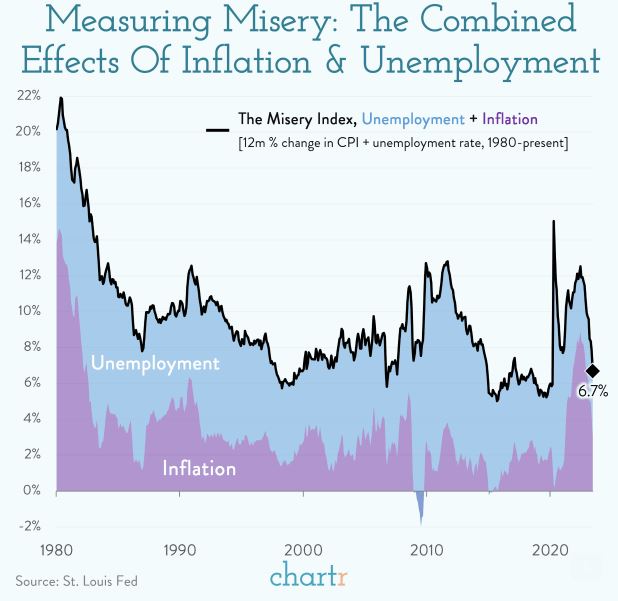

As we wait with anxious breath for the CPI and PPI inflation numbers later this week, I ran across the below graph.

I find it absolutely fascinating the correlation between these two data points. Is inflation causing unemployment or the other way around? From a consumer’s perspective it sure seems like manufacturers raise prices to offset or compensate for dipping sales due to the lack of demand from the unemployed.

But this goes against high school economics 101; supply and demand.

This graph is called the Measure of Misery or the Misery Index. Right now it stands at 6.7%, not too miserable compared to the average of 9.5% from 1980 to 2023.

Have a fantastic week and always here to help.