Being in this business for over 20 years, there are words that stick out like a sore thumb.

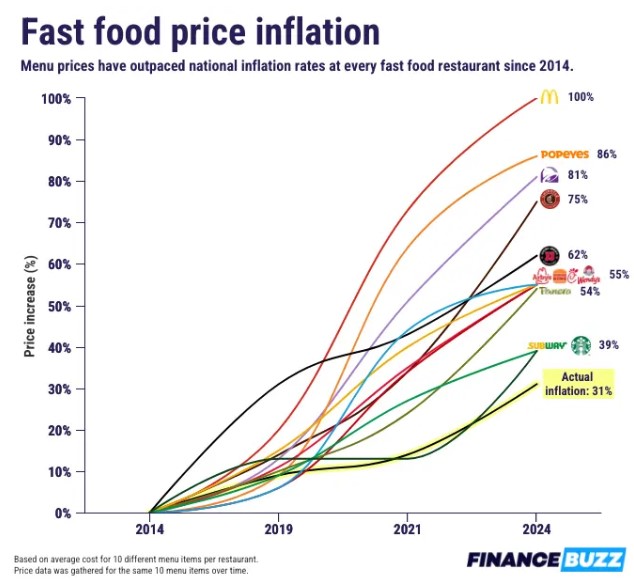

One of those words is Trading down. During the 2008 Financial crises, I recall the headlines about how well the beer industry was doing. Generic brands got a boost as did other Trading Down brands.

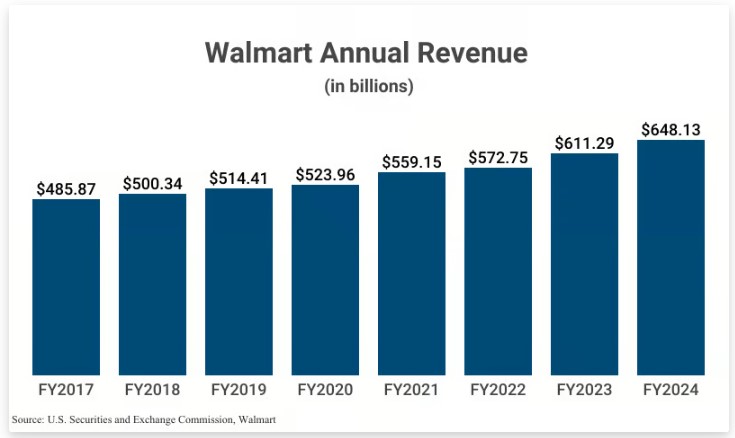

Walmart posted strong earnings yesterday. The reason this is important is they are a good barometer on the overall economy.

The higher income earners are Trading Down. They have a long way to drop opposed to lower income consumers who are close to the bottom. This is a sign that consumers are struggling with the pandemic savings exhausted and personal savings rate at very low levels.

Credit appears to also be tapped out. Buy now pay later has a very high delinquency of over 43%.