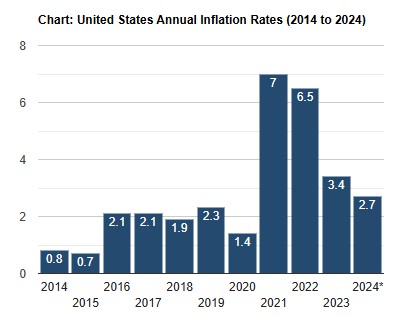

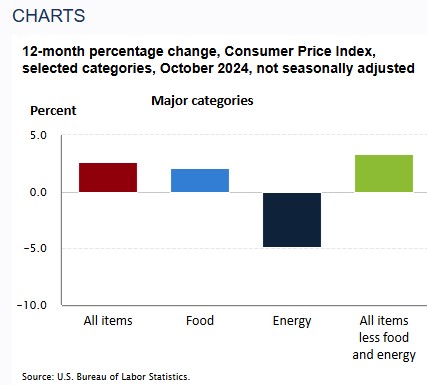

ISM Service report stated the reason for the rise in activity was because of the fears of future inflation caused by Tariffs causing a negative bond market reaction.

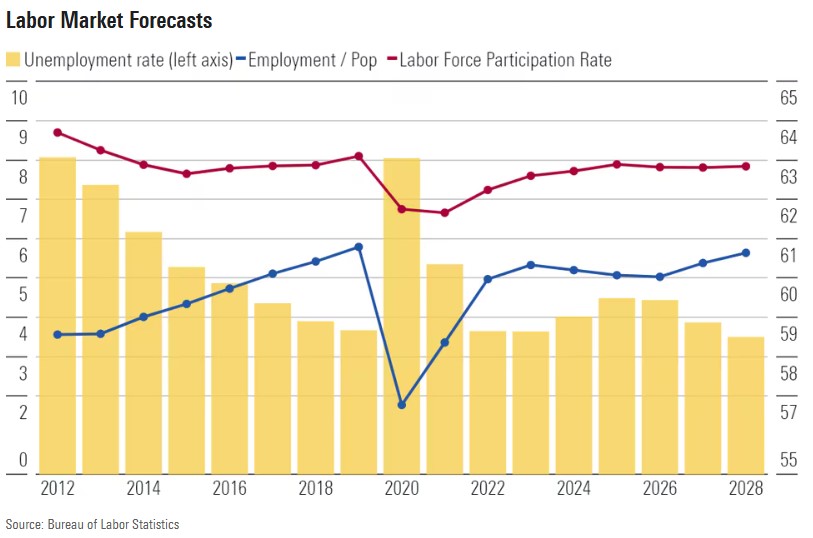

The JOLTS -Job Openings and Labor Turnover Survey show job openings rose from 7.839M to 8.098M. Stronger than expected. Hiring rate fell from 3.4% to 3.3%. Lowest since 2013.

Vacancy to Unemployment ratio compares the job openings to number of unemployed. its a different way to see what is going on. It is at 1.1 the biggest decline from the peak of 2%. This shows the labor market is actually cooling.

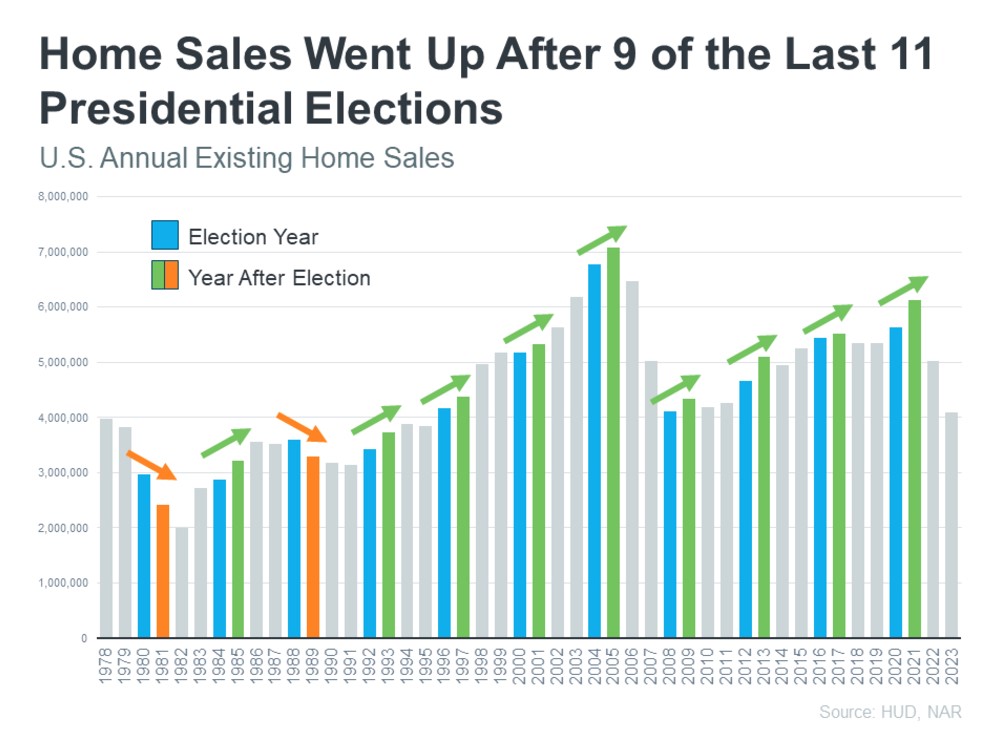

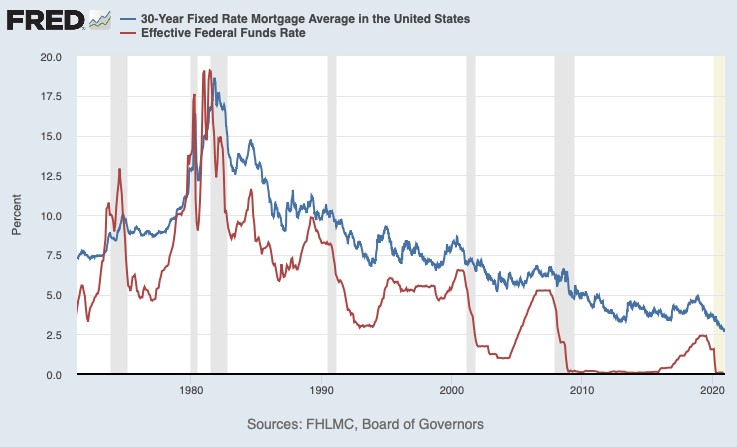

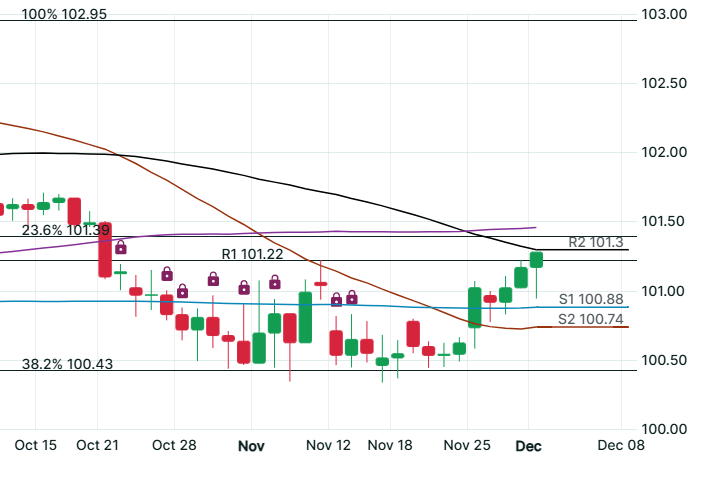

How does this affect us? Rates are stubborn. we are up one point since the election with no solid signs of dropping anytime soon.

If you are waiting for rates to drop before you buy a home, Don’t. Home values have gone up 3.4% in 2024 and expected to rise 3.8% this year per CoreLogic forecasts.

Sure it will cost you to refinance later but the increase in home value, the tax deductions an buying with less competition far out way the downside of waiting.

To put a fine point on this, historically rates are in the range of 6.5% to 8.5%.

http://www.YourApplicationOnline.com