How Good or Bad will the reciprocal tariffs be?

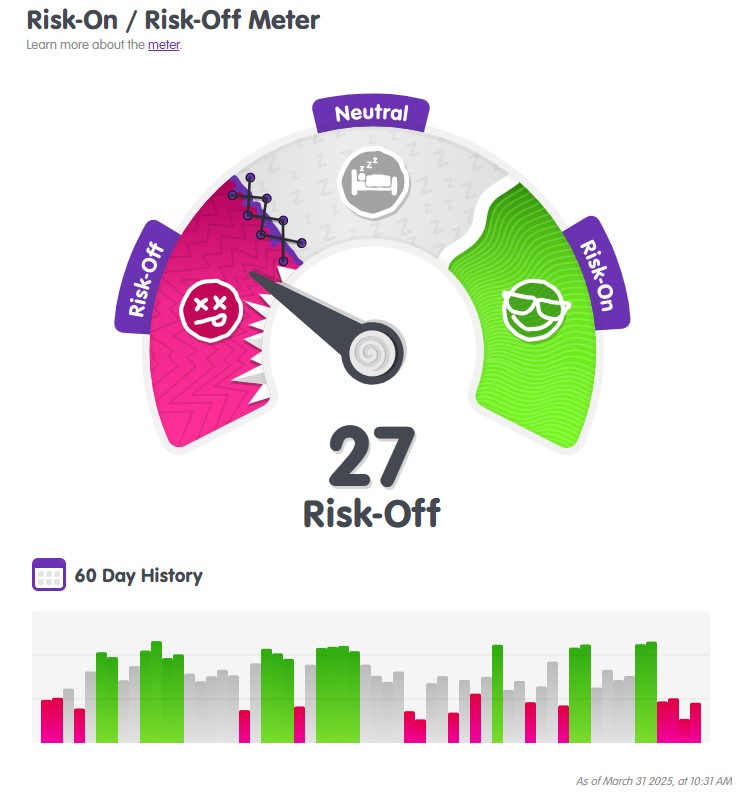

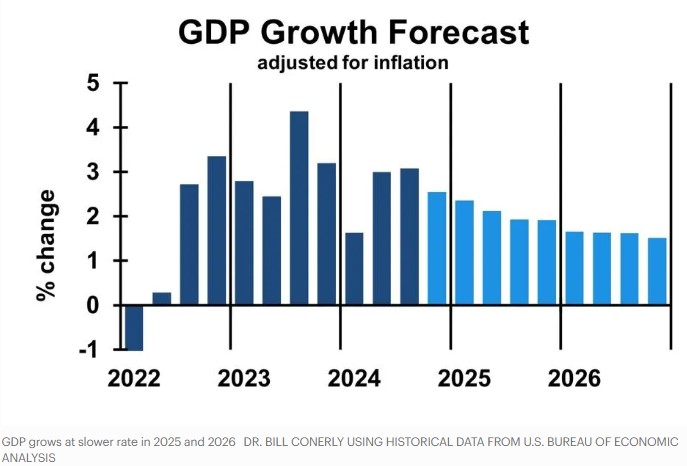

Worst than expected – Risk off flight to safety, Bond will benefit, rates improve.

Better than expected – Risk On, back to the stock market at the expense of the Bond market.

Stay tuned 4pm ET.

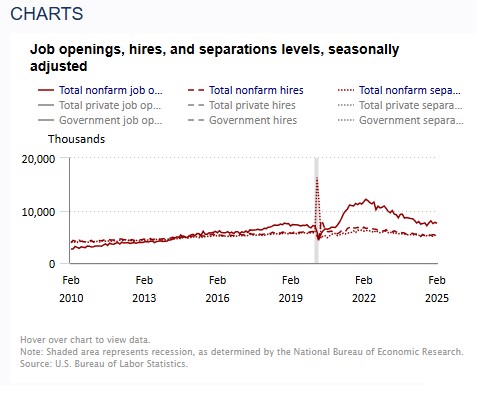

ADP Jobs report was stronger than expected spread out between all business sizes and sectors.

Job stayers had pay increase of 4.6% annually. seems high but actually the lowest level since June 2021.

Job changers saw an increase of 6.5% down from 6.8% last month.

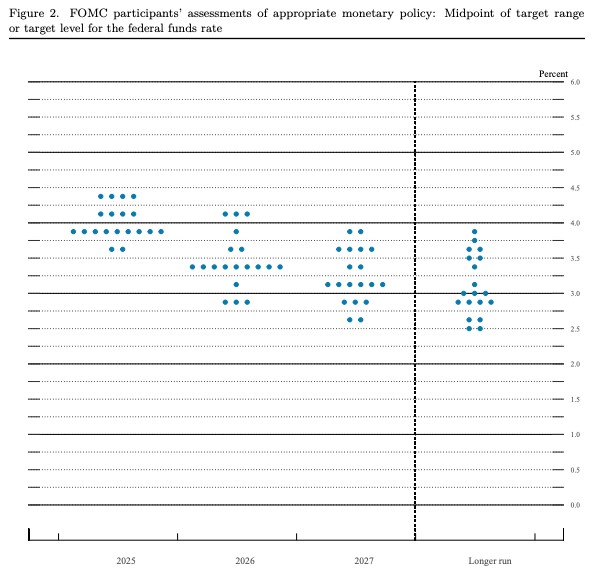

No one likes the unknown especially business owners who have to plan months to years in advance. Tariffs if you love them or hate them are disruptive especially the way these are being rolled out.

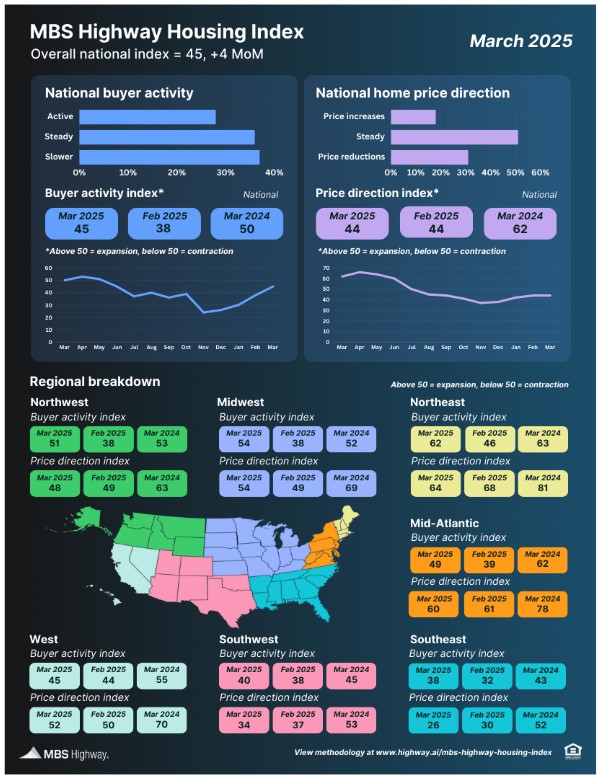

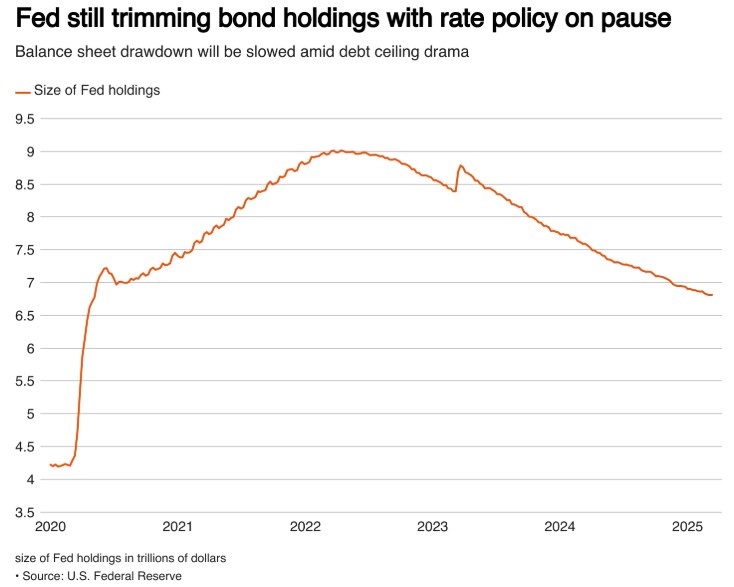

Rates have improved the last few weeks and we hope to continue this trend.

http://www.YourApplicationOnline.com