Her point: with employment growth averaging just 35,000 over the past three months and unemployment at 4.3%, there’s already more than enough reason to start cutting rates now.

It’s like a rock rolling down a hill, much easier to stop early than to wait until it’s gained momentum and rolls right over you.

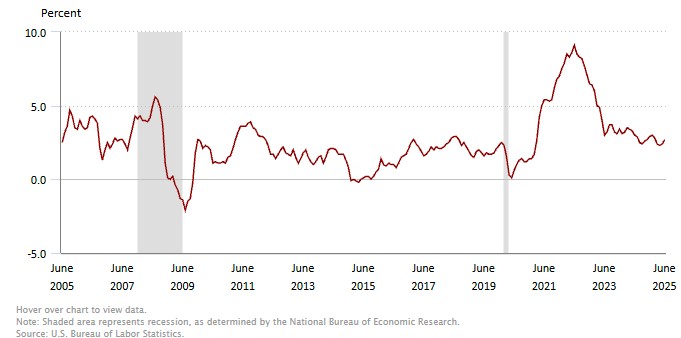

We expect inflation to rise, but not for the reason you might think.

Remember, inflation is measured against the previous 12 months. This month’s reading will likely be a modest 0.16%–0.20%, replacing an already low 0.19% from last year.

It’s a busy reporting week ahead. CPI as mentioned above, PPI, initial Jobless Claims, Retail Sales and more.

We’re continuing to float our clients as current technical indicators show no signs of imminent risk.

Shout out to the open house agents working hard this Sunday, always great to hear your perspective from the field.

Apply now http://www.MortgageNews.Blog soft credit pull.

12-month percentage change, Consumer Price Index.