The President backed off tariff threats toward the EU, and Greenland is effectively off the table. That reduction in geopolitical noise matters, uncertainty and instability hurt everyone, particularly stocks and bonds.

On the data front, Q3 GDP growth came in stronger than prior estimates at 4.3%, reinforcing the case that the economy can withstand rate cuts without reigniting inflation. Jobless claims remain stable at 200,000, while continuing claims fell by 26,000, signaling ongoing labor market resilience.

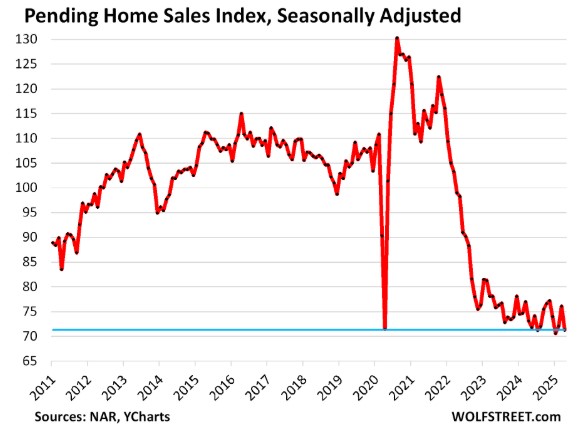

The outlier was Pending Home Sales, which declined 9.3% in December and are now down 3% year over year. That said, we expect this to turn in Q1, as early indicators show buyer activity picking up alongside improved rate stability.

Rates continue to fluctuate, but within a relatively tight range. All in all, the backdrop is constructive, let’s get 2026 rolling.

Online Application http://www.YourApplicationOnline.com