The President instructed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities. This is effectively Quantitative Easing (QE), the purchase of bonds to add liquidity and support lower interest rates.

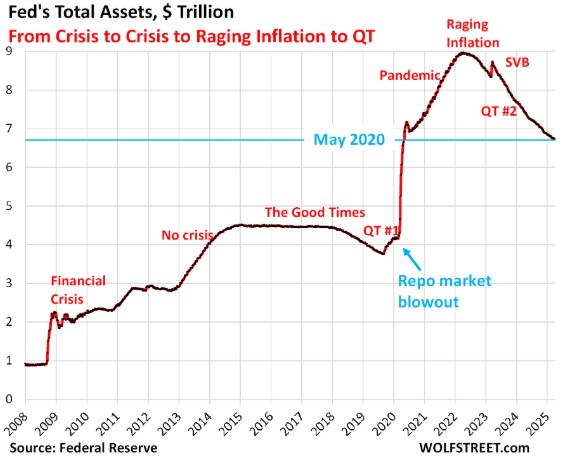

For the past five years, we have been in Quantitative Tightening (QT), where the Fed has been reducing its balance sheet by selling Treasuries and MBS. That prolonged selling pressure has pushed bond yields higher and, as a result, negatively impacted mortgage rates.

A shift away from QT toward QE is meaningful for housing and could provide much-needed relief for rates.

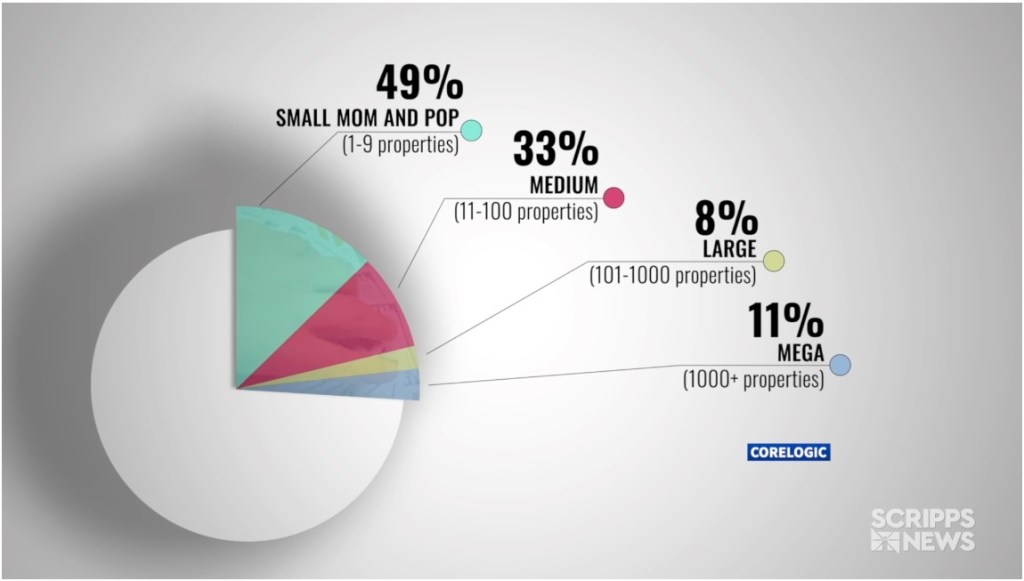

The President also strongly suggested curbing large institutional investors from purchasing single-family homes. The intent is to prevent big corporations from “gobbling up” housing inventory and instead prioritize owner-occupants and very small investors.

Limiting bulk purchases by large funds could help stabilize home prices, increase available inventory, and improve affordability for individual buyers, especially first-time and move-up homeowners.

This isn’t a new concept. Variations of this proposal have been discussed for years, including by lawmakers on the other side of the aisle, particularly as institutional ownership of single-family homes has grown.

Time to get pre-qualified for a purchase or refinance http://www.YourApplicationOnline.com