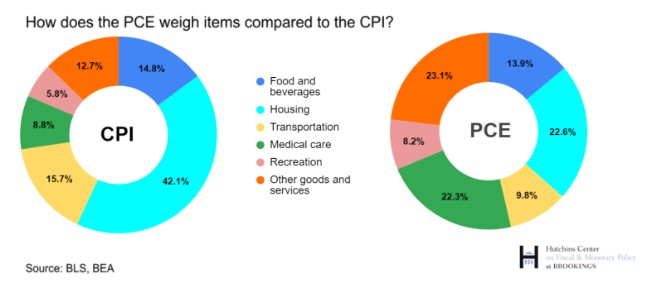

Rents make up the largest share of both the CPI and PCE inflation reports, followed by transportation/energy, with food and beverages coming in third.

While you might expect recent actions involving Venezuela to be destabilizing and push oil prices higher, the opposite has occurred. Concerns about a future oversupply of oil are driving prices lower, outweighing geopolitical risk.

Anecdotally, as consumers continue to tighten their belts, manufacturers and retailers are feeling the pressure and are responding by lowering prices to maintain demand.

All of this means lower Mortgage rates and more incentive for the FEDs to cut rates further. 2% inflation is on the horizon.

Let’s get you pre-qualified http://www.YourApplicationOnline.com