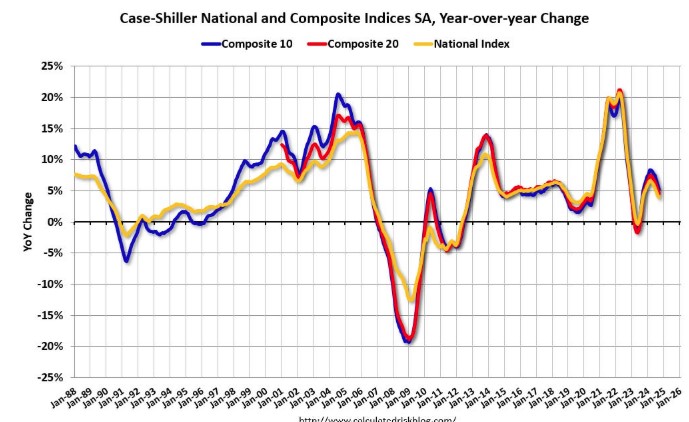

As rates begin to fall, home values tend to rise. Over the last three months, we’ve seen home prices move higher, a clear shift after five consecutive months of declines.

So what does this mean for buyers, especially first-time buyers?

Waiting for the “perfect” moment, lower rates and lower prices can be costly. While you wait, the market keeps moving forward.

When rates drop, more buyers re-enter the market. More buyers mean more competition. More competition almost always means higher prices.

The result? Any benefit from a slightly lower rate is often offset by a higher purchase price and fewer options to choose from.

Timing the market is difficult. Positioning yourself correctly within it is far more important.

Start the new year with a fresh look, a mortgage financial checkup. Even if we uncover something unexpected on your credit report, there’s still time to address it, fix it, or remove it.

With spring just around the corner, now is the perfect time to get pre-qualified and be ready when the right home hits the market.http://www.YourApplicationOnline.com