The Fed’s primary focus remains inflation.

Controlling inflation is central to the Fed’s mandate, and every major policy decision flows from that objective.

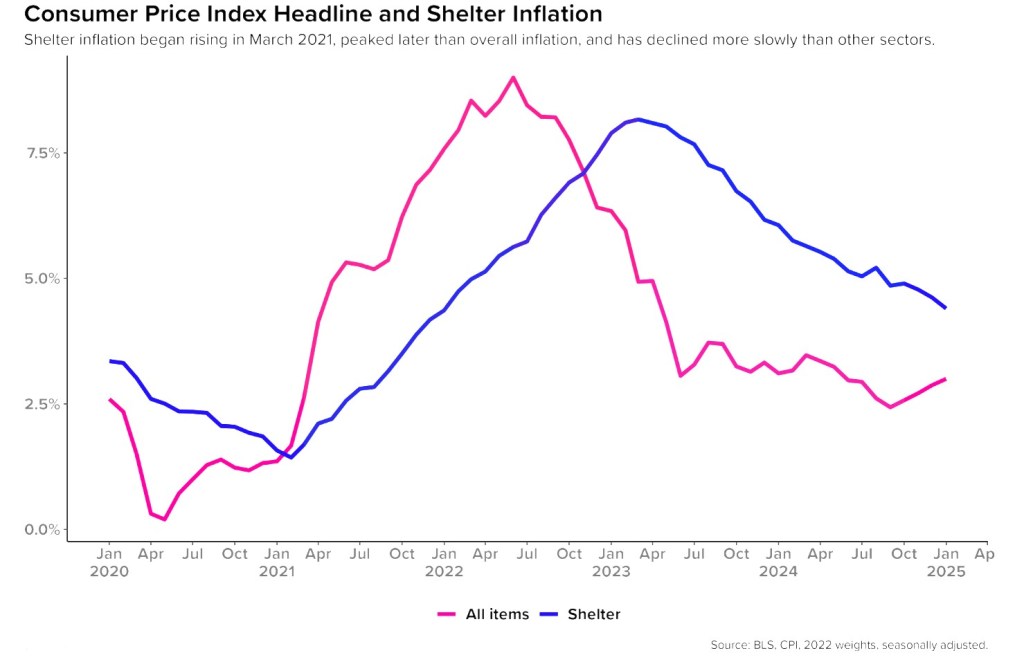

The Consumer Price Index (CPI) will be released tomorrow morning.

Current expectations are for inflation to remain stable at 3.0%, which would reinforce the recent trend of cooling price pressures rather than renewed acceleration.

Housing costs continue to do the heavy lifting.

A key reason inflation is holding steady is that rents are still trending lower. Shelter is one of the largest components of CPI, so even modest declines there have an outsized impact on the overall number.

Why this matters for rates.

If CPI comes in as expected or softer it supports the bond market’s case that inflation is gradually easing, giving the Fed more room to consider rate cuts rather than hikes.

In short: stable inflation, easing rents, and a patient Fed are the combination the bond market has been waiting for.

Lets get you ready for the new year. http://www.YourApplicationOnline.com