Rates Continue to Improve

Rates are trending lower again, much like when Powell hinted on August 22nd about a potential September rate cut. We’re seeing a similar pattern now, with a high likelihood of another rate drop within the next two weeks.

The bond market, which primarily drives mortgage rates (via the 10-year Treasury), tends to “price in” expectations ahead of Fed action so the improvement we’re seeing today is the market’s way of preparing for what’s likely coming next.

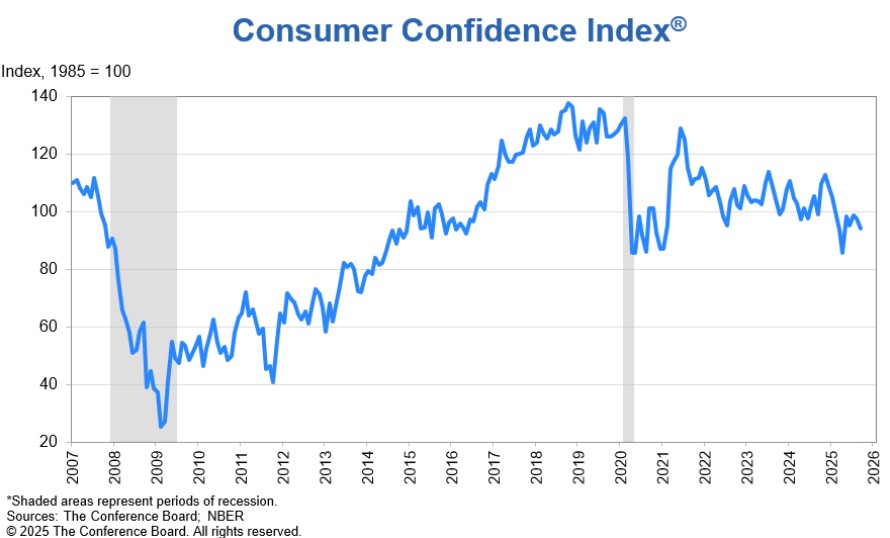

Consumer Expectations Show Rising Concern

The Consumer Expectations Survey for September indicates that consumers are growing more pessimistic about the labor market. This shift in sentiment is something the Federal Reserve watches closely, as weakening confidence often signals slowing economic momentum.

With the Fed increasingly focused on employment trends, this data adds further weight to the case for future rate cuts.

Know someone looking to refinance or purchase? happy to help and we are nationwide. http://www.YourApplicationOnline.com