AI is transforming the mortgage industry by streamlining processes that once took days into tasks completed in minutes.

From automating income and asset verification to detecting fraud and reducing underwriting errors, AI helps lenders work faster, smarter, and with greater accuracy.

It also enhances borrower experiences by delivering quicker approvals, personalized loan options, and clearer communication.

The real power of AI in mortgages is its ability to combine efficiency with intelligence, freeing loan officers to focus more on relationships and strategy while technology handles the heavy lifting.

Highlights this morning

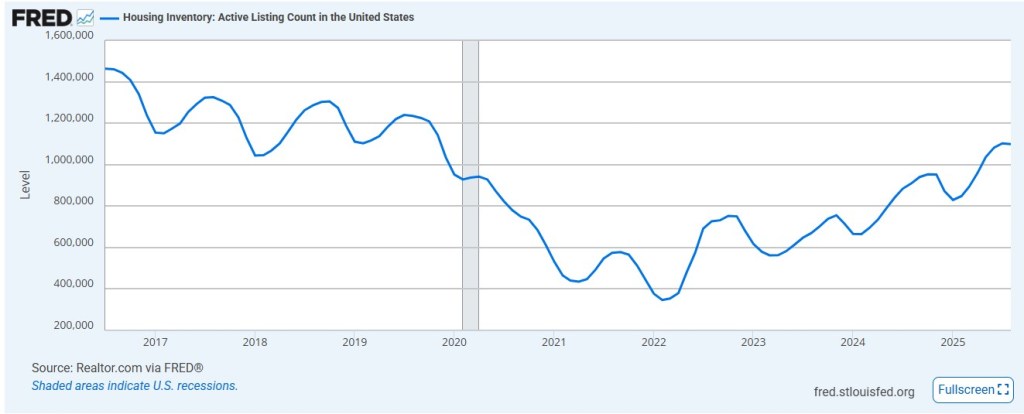

- Housing Inventory up 11% year over year

- GDP increased 2% slightly below expectations

- Initial Jobless Claims lower than expected, but revisions will follow.

Lets get you pre-qualified http://www.YourApplicationOnline.com