Since Powell’s speech on August 22nd, rates have improved by an average of 3/8%. The market had already priced in, and then received, the Fed’s 25bp cut.

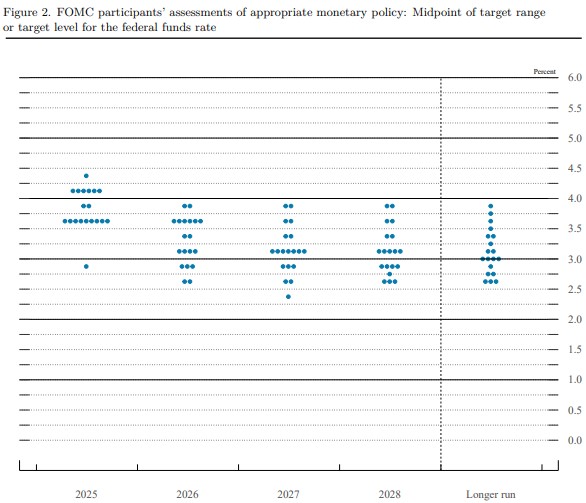

Yesterday, Powell emphasized that policy remains clearly restrictive and signaled there’s still room for further cuts.

While inflation has been the Fed’s primary focus, the shift toward rising unemployment and growing downside risks to the labor market is now front and center.

So why did the rates go up when they are supposed to go down, right?

This morning’s Initial Jobless Claims came in lower than expected, which sparked a bond market sell-off. Money managers in this space react like a feral cat, jumping at their own shadow.

When we invest, we think in terms of dollars and long-term growth. Bond money managers, on the other hand, are often focused on pennies and the very short term.

These expectations are forward-looking, and if the bond market reacts the way it typically does, we should see movement ahead of the actual cuts, just like we saw back in August.

Hang in there… apply online http://www.YourApplicationOnline.com