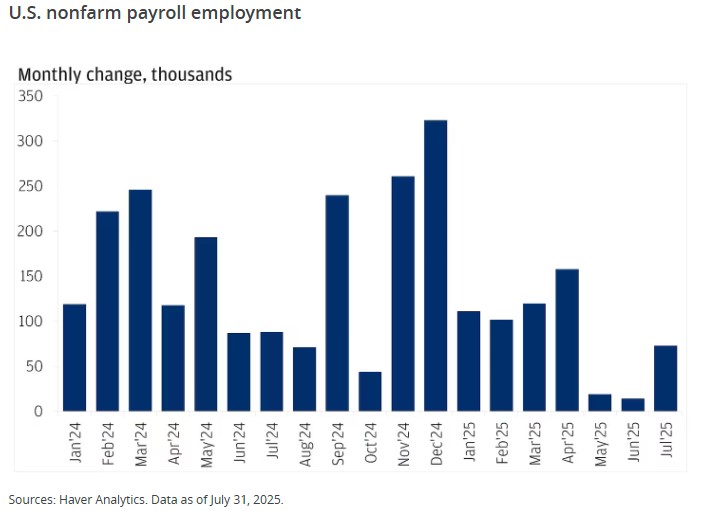

Even with a new head at the Bureau of Labor Statistics (BLS), the jobs report didn’t get a makeover. We still saw a weak headline number and downward revisions to prior months. Ouch.

Because as much as we’d all like a little spin… numbers don’t lie.

The unemployment rate ticked up from 4.2% to 4.3%. It may not sound like much, but in Fed-speak, that tiny move can feel like a megaphone. Weak jobs plus rising unemployment = a bond market that starts thinking “rate cuts, rate cuts, rate cuts.”

The odds are now 100% for a 25bp rate cut in September, 75% for another in October, and 70% for a December cut.

Once rates move down in a meaningful way, refinance activity will surge. Let’s get you pre-qualified now so you’re ahead of the rush when it hits.

http://www.YourApplicationOnline.com