It’s basically the Fed’s “boots on the ground” look at the U.S. economy. Instead of just charts and data, it gathers anecdotal information from businesses, community leaders, and economists across all 12 Federal Reserve Districts.

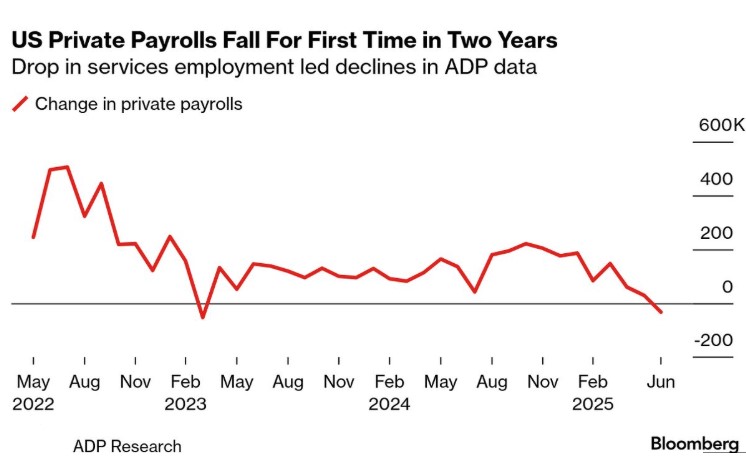

It shows a weakening labor market and with the ADP report confirming, the FEDs have plenty of data to make their move on rates.

We expected 75,000 job gains but only got 54,000 with initial jobless claims rising over 8,000.

Bond Market responded this morning and the mortgage rates dropped.

Remember, the Federal Reserve’s role is to either cool down or stimulate the economy. Raising rates slows things down, while lowering rates helps speed things up. When borrowing costs drop, the cost of doing business becomes cheaper, fueling growth and opportunity.

Lets get you pre-approved today http://www.YourApplicationOnline.com