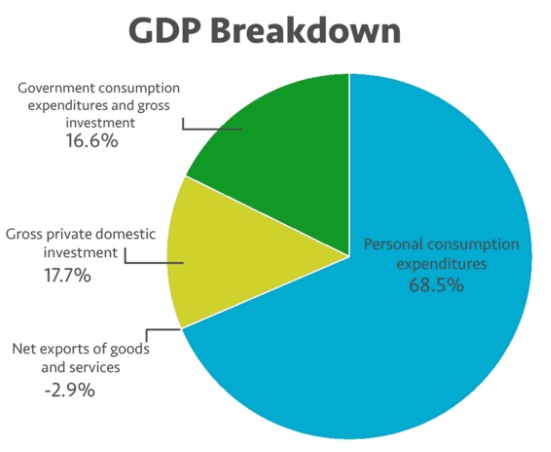

Consumer spending drives 68% of GDP, which means the economy lives and dies by how confident people feel about their wallets. The catch is, it’s not just about the money in their accounts, it’s the sense of wealth.

When people feel richer, they splurge. When they feel squeezed, they cut back fast. That psychology is the Fed’s biggest blind spot: they track the numbers after the fact, while the spending mood can change overnight.

Existing home sales rose 2% in July to a 4.01M unit annualized pace, well above expectations of just 0.5%. Some genuinely good news in housing.

My thoughts:

Powell spoke today, and appeared to give the green light on cuts. He noted the downside risk of employment. We are all collectively crossing our fingers that it will have a positive impact on mortgage rates.

Time to apply for that new home http://www.YourApplicationOnline.com Soft Credit pull.