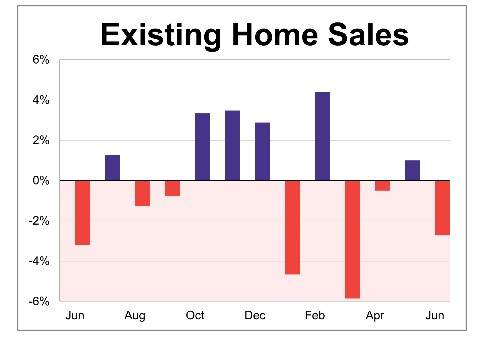

Closings in June reflect contracts written back in April and May, when interest rates were at their highest levels since last year. At first glance, the numbers might make you say “OMG,” but it’s important to dig deeper.

Despite the headline reaction, there’s still a strong case for lower rates ahead and increasing inventory. Yes, inventory has been ticking up—but so have rates. The market remains in flux, and understanding the timing behind the data is key.

In a strained housing market, rising inventory tends to bring buyers off the sidelines. Combine that with lower interest rates, and you’ve got the ingredients for a real frenzy.

My thoughts and insight:

Housing prices aren’t going down—they’ve likely stabilized and become more in line with reality. That’s not a bubble bursting; it’s normalization.

Even in some of the hardest-hit areas like Florida and Texas, where we’ve seen price declines, values are still significantly higher than they were in 2019. The long-term fundamentals of the housing market remain strong.

Get pre-qualified, get your clients pre-qualified soft credit pull http://www.YourApplicationOnline.com