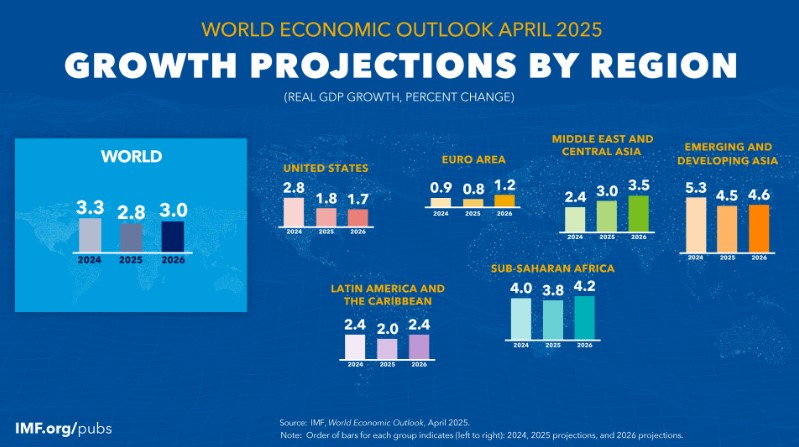

The Federal Reserve concludes its two-day policy meeting today, with a statement scheduled for release at 2:00 PM ET.

Alongside the announcement, they will also publish the latest Summary of Economic Projections (SEP), which includes updated forecasts for inflation, unemployment, GDP growth, and the federal funds rate.

Recent economic indicators suggest clear signs of a slowdown. Both retail sales and industrial production—highlighted in yesterday’s data—posted declines.

Additionally, manufacturing has been in a prolonged period of weakness, reinforcing the broader narrative of decelerating economic momentum.

My take: I don’t get it. The Fed seems to have strayed beyond its mandate—so afraid of making a misstep, they don’t realize that hesitation is the misstep.

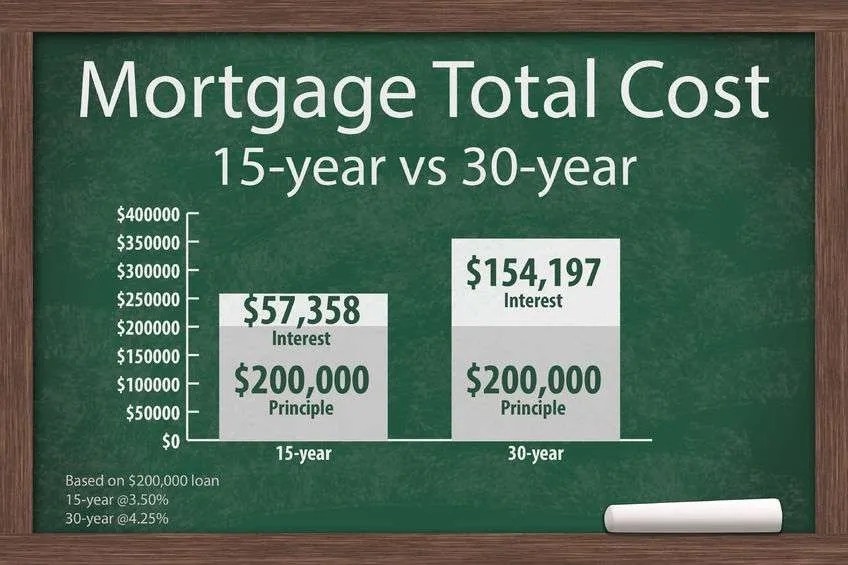

Side note: I just ran numbers for a client who purchased last year with a rate in the mid-7s. We’re now refinancing into a 15-year loan in the high-5s. Their monthly payment is nearly identical—but we’ve eliminated 14 years off their mortgage.

http://www.YourApplicationOnline.com