It’s still unclear whether the full effect of the tariffs has hit the market yet.

Tomorrows Producer Price Index will probably tell us more in the next round of data since it tracks what businesses are paying for goods — which often shows inflation trends before they hit consumers.

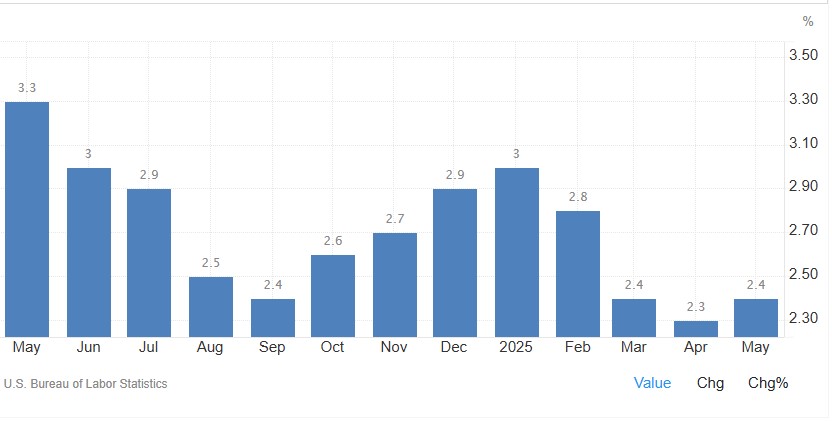

The Consumer Price Index (CPI) came in at just 0.1% — well below expectations. However, on a year-over-year basis, inflation still edged up slightly from 2.3% to 2.4%, just under the street’s forecast of 2.5%.

The World Bank lowered its global growth outlook from 2.7% to 2.3%, and cut U.S. growth projections from 2.3% to 1.4% — yet another sign of economic retraction.

Taken together with the softer-than-expected inflation numbers, this could give the Fed additional incentive to move toward rate cuts sooner rather than later.

Let’s get you financially tuned up and ready to buy, sell or refinance. http://www.YourApplicationOnline.com