The Consumer Price Index (CPI) report is set to be released this Wednesday. This release is especially important because it will be the first month reflecting the early impact of the new tariffs.

Let’s talk impact of Inflation bonds and mortgage rates.

Inflation reduces the purchasing power of money over time — meaning a dollar today buys less in the future.

How this affects the bond market:

- Bond yields rise with inflation:

Investors want to be compensated for the loss of purchasing power. If inflation is rising, they’ll demand higher yields (interest rates) on bonds to make up for it. - Bond prices fall:

When yields go up, existing bond prices drop. This is because older bonds with lower fixed rates become less attractive compared to newer ones offering higher returns. - Longer-term bonds are hit harder:

The further out the maturity, the more inflation can eat away at returns. So long-term bonds typically drop more in price when inflation expectations rise.

In short:

Inflation = higher yields = lower bond prices.

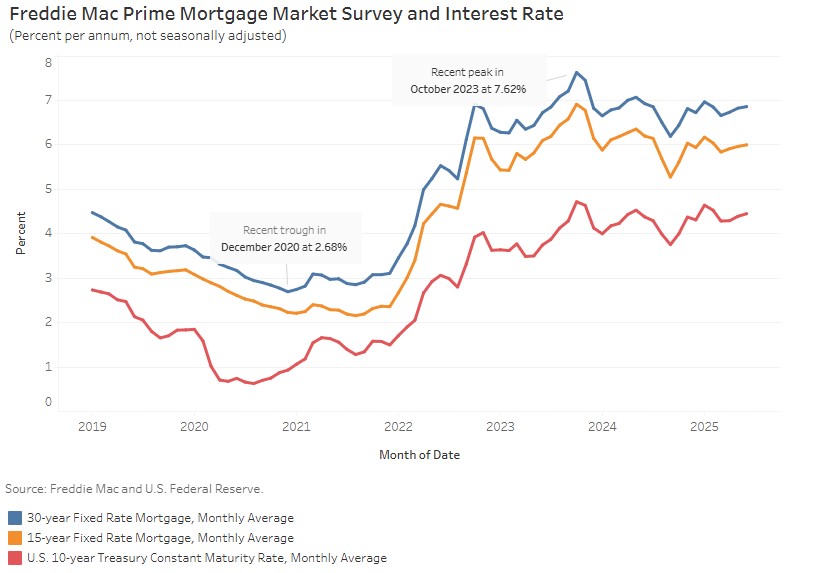

And since mortgage rates are closely tied to the bond market (especially the 10-year Treasury), inflation often means higher mortgage rates too.

http://www.YourApplicationOnline.com