A face-to-face meeting between Fed Chair Powell and the President — described as cordial at best.

We’re all hoping for mortgage rates to come down. Elevated rates are putting pressure on the housing market, keeping millions of homeowners locked into sub-3.25% mortgages and discouraging them from selling. This dynamic contributes to historically low inventory and, in turn, continues to push home prices higher.

At some point the cure is worse than the disease.

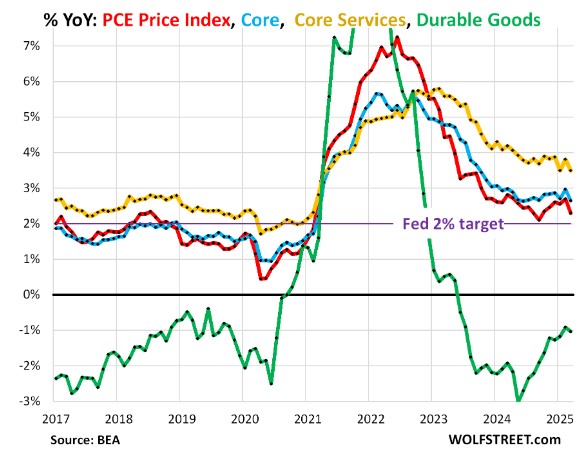

Personal Consumption Expenditures (PCE) rose 0.2% as expected

- Personal Consumption Expenditures (PCE) rose 0.2% as expected

- Incomes rose 0.8% expected as 0.3%

- Social Security payments rose 6.9%

- Trend for PCE continues to move down. Good News.

Have a fantastic weekend. we feel the tide shifting in the right direction.

http://www.YourApplicationOnline.com