Tariffs, tariffs everywhere, but not a drop to drink. The erratic, on-again, off-again nature of tariff announcements creates a nightmare for money managers.

Money flows in two directions: the stock market and the bond market. A surge in one pulls from the other, shifting the balance constantly.

Mortgage rates are directly linked to Mortgage-Backed Securities (MBS) bonds. Homebuilders closely monitor rate trends, as their projects typically take 6 to 18 months from groundbreaking to occupancy.

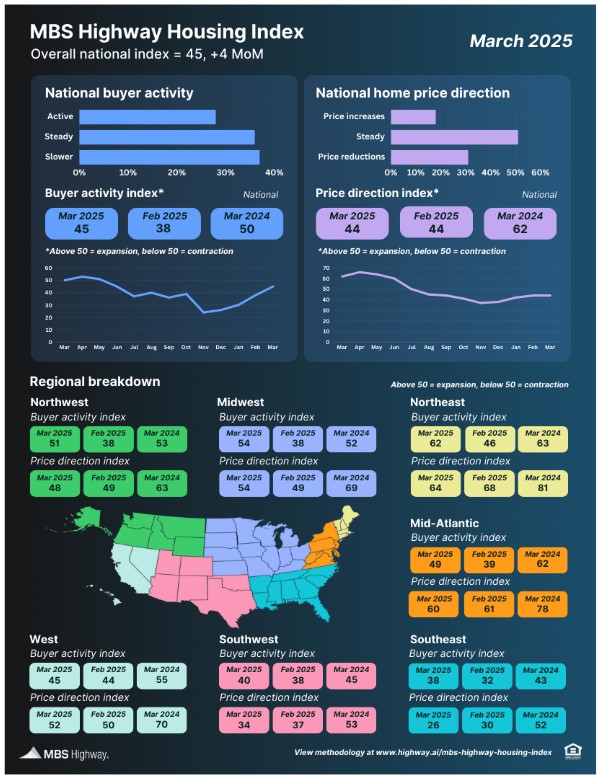

Buyer activity is directly tied to interest rates—we see it every day. Lower rates drive more applications, more offers, and more contracts, creating a win for everyone. That is, until rates rise again.

The long-term trend points to lower rates. Focus on the bigger picture, not the short-term fluctuations, and we’ll all be fine. Watch the dog not its tail.

http://www.YourApplicationOnline.com