We all have a tendency to delay things that may be critically important. Every now and then, it’s worth looking up to check the ceiling before a leak appears.

From a mortgage standpoint, we encourage our clients to get fully approved through underwriting before purchasing or refinancing. Rates are starting to move in the right direction, and once they shift significantly, the rush will be on. Being prepared now can put you ahead of the curve!

Now lets get to the data:

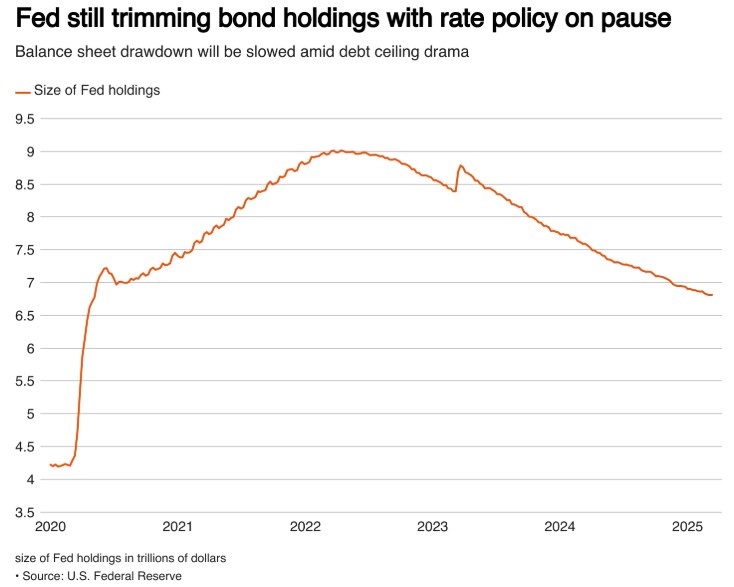

The Fed kept rates unchanged, as expected, and made key adjustments to their balance sheet runoff. Previously, they allowed $25B in bonds to mature and be paid back instead of reinvesting. Now, they’re making changes to this process by re-investing. which could impact the market.

Simply put, Quantitative Tightening (QT) means reducing the Fed’s balance sheet by letting bonds mature without reinvesting. Quantitative Easing (QE) is the opposite—it involves reinvesting those funds to keep money flowing in the economy.

These are all signs of future lower Fed rate and Mortgage rates.

get pre-approved today. http://www.YourApplicationOnline.com