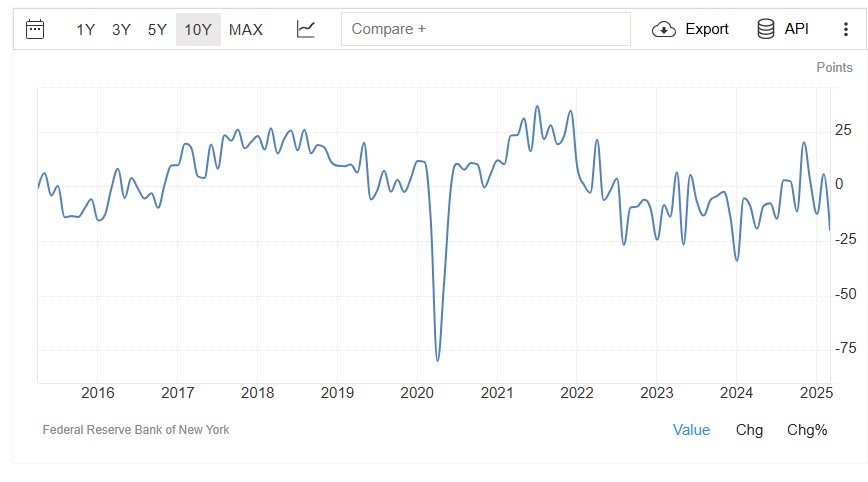

The Empire State Manufacturing Index dropped to -20, significantly weaker than the expected -1. New orders index also dropped 14.9 as well as shipments index to -8.5.

Looking at the long-term trend in the graph, it’s clear that this index has been quite volatile. Let’s take a closer look to determine whether this decline is a serious concern.

Inventory continues to grow. This is concerning. Business optimism continues to decline while prices rose at the fastest pace in two years.

The Fed must consider whether to cut rates sooner rather than later or risk falling into analysis paralysis.

Inflation declines when consumers opt for chicken over beef and brew their own coffee instead of buying Starbucks. Supply and Demand.

The case for lower interest rates is stronger today than it was yesterday. Now is the time to get your mortgage paperwork in order—let’s get you pre-qualified for your purchase or refinance!

http://www.YourApplicationOnline.com