OPEC plans to gradually increase production starting in April. Since oil influences nearly every aspect of the Consumer Price Index and other inflation-related metrics, this shift could have widespread economic effects.

In response, the bond market moved in a rate-positive direction.

As for tariffs, while the media often focuses on fear-driven narratives, the reality is more nuanced. Most goods we buy and sell contain components sourced from various parts of the world, which means the actual impact of a 20% or 25% tariff will likely be less severe than the headline figures suggest.

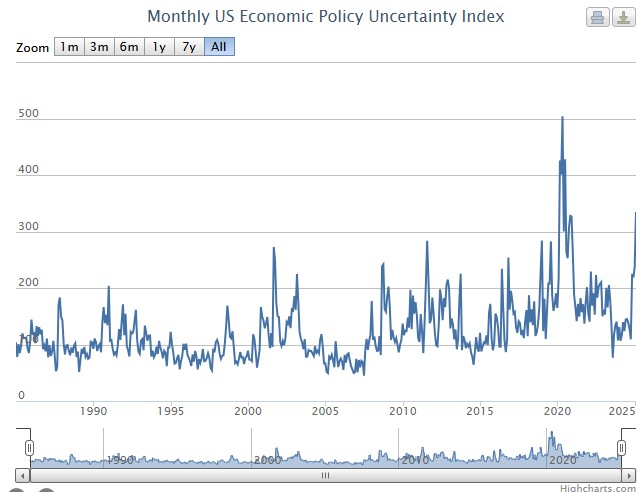

The Uncertainty Index rose significantly the last week including today. This and the new fear of a recession is something the FEDs cant ignore. the Fed rate may be lowered as soon as May.

In my view, things are rarely as bad or as good as they seem, but the uncertainty is undeniable. Ultimately, this trend points toward lower mortgage rates.