I’m sure that got your undivided attention – Not…

But its important and why the rates may actually start dropping.

Quantitative Easing (QE) is when a central bank injects new money into the economy by expanding the money supply. Think back to the 2008 financial crisis and the COVID-19 pandemic—during these periods, the Fed was aggressively pumping money into the system.

Quantitative Tightening (QT), on the other hand, is the process of reducing the money supply. The Fed has been shrinking its balance sheet for years, which has contributed to rising Fed rates and mortgage rates.

Net Neutral is exactly what it sounds like—neither QE nor QT. It’s a steady-state monetary policy where the Fed maintains the status quo without expanding or contracting the money supply.

This is a big deal. Net Neutral is the next step to QE and lower interest rates.

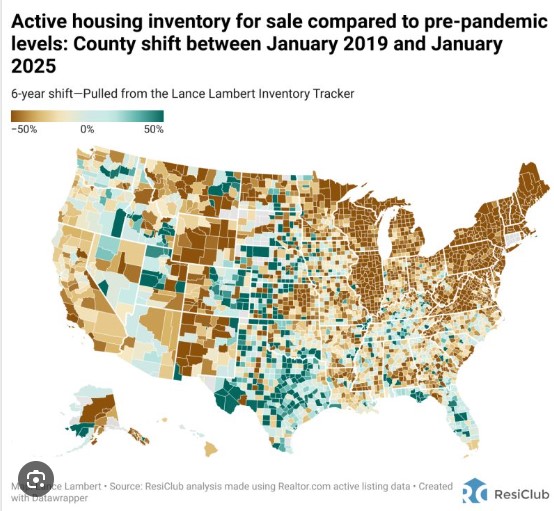

We’re starting to see a shift toward a buyer’s market, as evidenced by the increasing number of listings being pulled. After years of rapid home value appreciation, prices have leveled off and are beginning to normalize. Sellers are catching on, reassessing their pricing strategies, and either adjusting their listings or temporarily stepping back from the market.

http://www.YourApplicationOnline.com