We have contrasting views on inflation from Fed President Beth Hammack and Fed Governor Christopher Waller. Hammack considers inflation an ongoing concern, opposed the December rate cut, and even supports the possibility of a rate hike this year.

In contrast, Waller, who I heard yesterday on CNBC, sounded much more dovish. He expressed openness to rate cuts as early as March.

My concern with high interest rates isn’t that they weren’t necessary at some point, but that the solution is starting to feel worse than the problem. It’s the small business owners, not the big corporations, who are unable to expand due to these high rates.

And it’s everyday people—trying to make ends meet or hoping to buy a home—who are being squeezed out of the market.

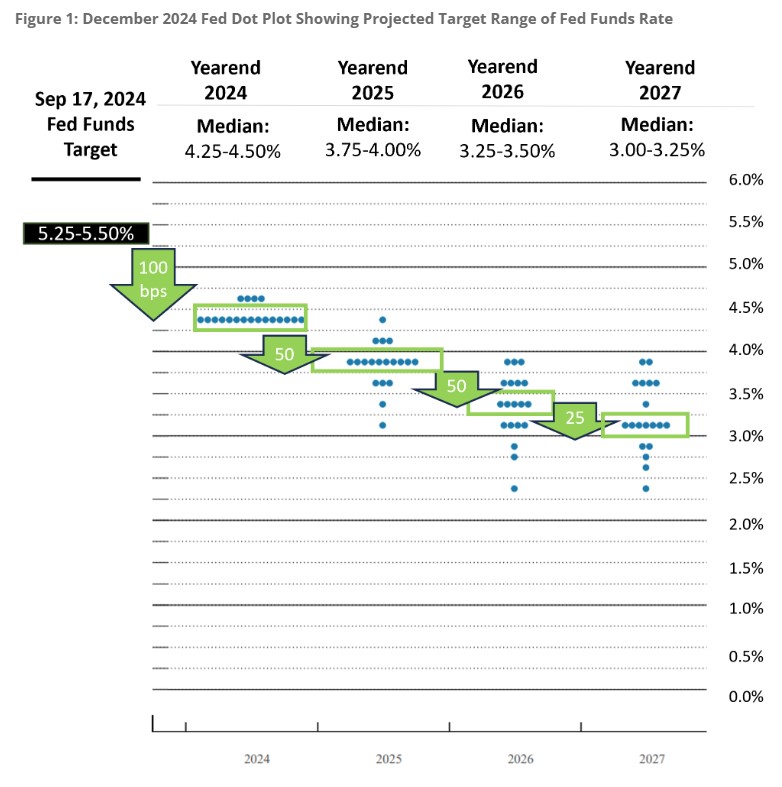

Each dot on the graph below (the Fed Dot Plot) represents a Fed President’s forecast for the future Fed Funds Rate. The trend is heading downward—great news!

I’m on a bit of a rant today—got up way too early, a full two hours before sunrise, and have been stewing over this ever since. Thanks for coming to my TED Talk. Wishing you a great weekend!