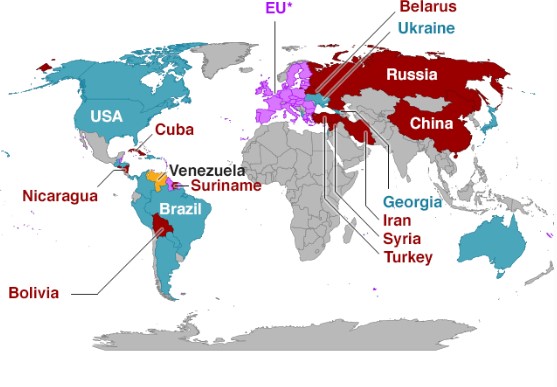

We received several bond-friendly economic reports, including ADP, JOLTS, Geo-Political tensions and overseas inflation data. Together, these developments are putting downward pressure on interest rates.

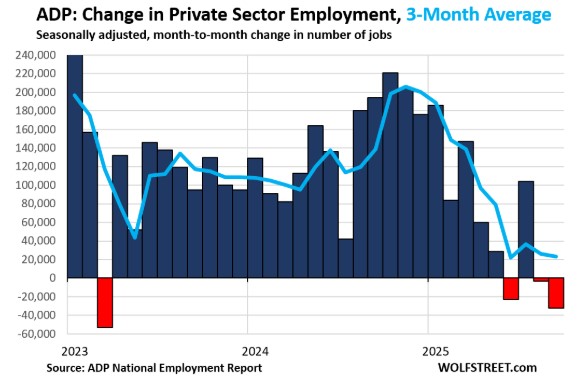

ADP Employment Report

ADP is considered the gold standard for real-time jobs data because it is based on actual payroll information rather than surveys.

- December job growth: 41,000

- Market expectation: 50,000

This miss reinforces the narrative of a slowing labor market.

JOLTS (Job Openings and Labor Turnover Survey)

The JOLTS report also signaled labor market weakness. It tracks:

- Job openings

- Hiring and quitting trends

- Wage growth for both job stayers and job changers

Results showed continued softening, particularly in wage momentum.

Job Growth Trend

The longer-term trend clearly shows deceleration:

- 3-month average: 20,000

- 6-month average: 22,000

- 12-month average: 51,000

- 2024 average: 144,000

Bottom Line

The labor market continues to weaken. Mortgage bonds reacted favorably, pushing rates lower, as markets increasingly expect job growth to either continue slowing or stabilize at lower levels in the coming months.

let’s get you pre-qualified http://www.YourApplicationOnline.com