Existing home sales rose 0.5%, coming in close to expectations and roughly in line with this time last year. Activity is still working through a bit of a lag, largely due to government shutdown, related data delays, and the recent drop in interest rates hasn’t fully shown up in the numbers yet.

The New York Fed President, a current voting member, spoke this morning. The takeaway: while he stopped short of making any firm commitments, his comments suggest there is room for additional rate cuts down the road. One challenge right now is that inflation data is incomplete, with October and parts of November still missing, making it harder for policymakers to draw firm conclusions.

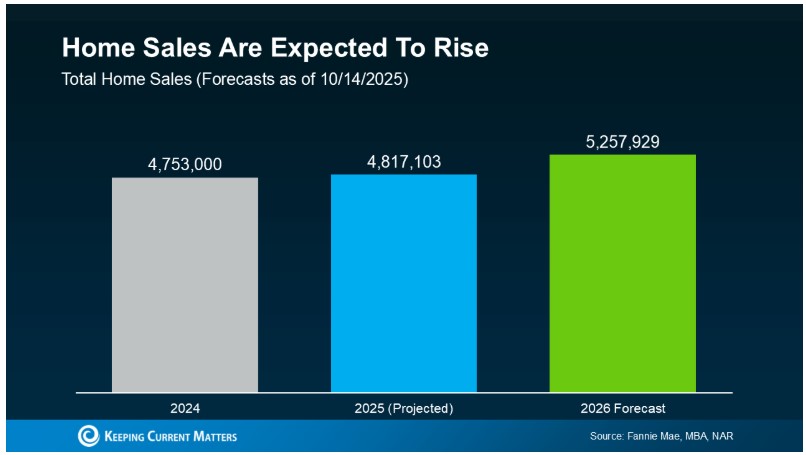

For now, rates are holding steady, and the bond market appears comfortable waiting for cleaner data. Looking ahead, if rates remain supportive and pent-up demand begins to surface, we expect a very active purchase and refinance environment in 2026.

let’s get you pre-qualified http://www.YourApplicationOnline.com