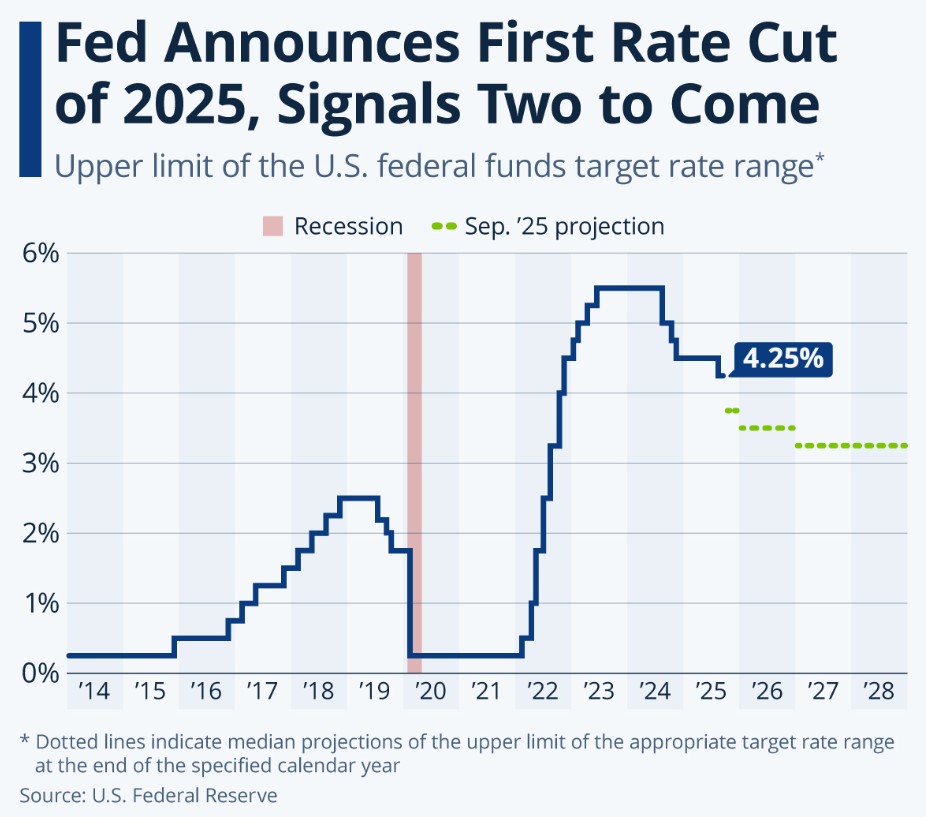

“A funny thing happened on the way to the forum… the Fed forgot to cut rates.

We all showed up expecting a grand performance, maybe a little drama, maybe a surprise plot twist but nope. Just Jerome Powell stepping out, clearing his throat, and saying, ‘Not today, folks.’

The audience groaned, the bond market spilled its popcorn, and mortgage rates quietly exited stage left.”

This is a synopsis of the October 29th Fed minutes just released.

The Jobs Report came in as a mixed bag… more like the bargain bin, really. We added 119,000 jobs, but the unemployment rate still managed to climb from 4.3% to 4.4%. And because the universe loves consistency July and August were revised downward. Funny how revisions never seem to say, “Surprise! More jobs than we thought!”

So how did the Bond market react?

Surprisingly well. Rates actually improved.

Just because the Fed decided to take their ball and go home doesn’t mean mortgage rates have to follow them off the field.

And here’s the real story: activity is picking up.

Not just calls, not just interest actual applications and, yes, real purchase contracts. The kind that have signatures, deadlines, and buyers who are actually doing something besides browsing Zillow at midnight.

It’s been years since we’ve seen this kind of movement… and it’s a very welcome change.

Let’s get you qualified http://www.YourApplicationOnline.com