Diana Olick, a real estate analyst for CNBC, once again managed to scare the holy crap out of everyone until you actually look at what she was referring to.

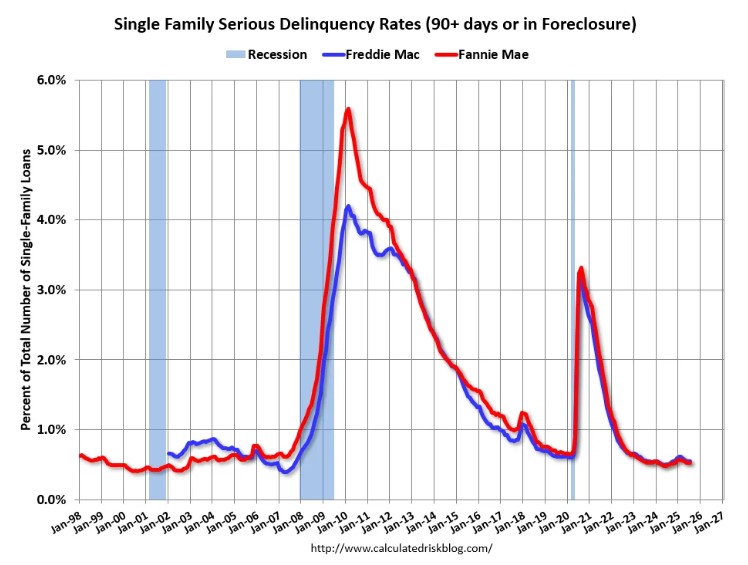

Foreclosure rates are sitting at historic lows, so even a tiny uptick can look dramatic when expressed as a percentage. That’s why the headlines sound alarming, but the reality is anything but.

When you look at the graph below, you can clearly see the increase is minimal not a sign of any real distress in the housing market.

It’s a toss-up whether the Fed will cut rates in December. Powell’s comments after the October 29th cut poured cold water on expectations, dropping the odds from 95% to 49%.

Meanwhile, most of the voting and non-voting Fed members still have blinders on, staying laser-focused on inflation while largely overlooking the weakening job market.

Rates are already low, and forecasts show 2026 shaping up to be a banner year for both purchases and refinances, with rates expected to drop even more significantly than in 2025.

Get out there and take charge. http://www.YourApplicaitonOnline.com