Despite comments from Fed members Susan Collins and Beth Hammack essentially saying, “Unemployment? What unemployment? Nothing to see here…”

There’s real data pointing to weakness in the labor market. Now that the government has reopened, the September and eventually October jobs reports will start to roll in. We expect they’ll confirm what alternative data has already shown: the labor market is getting tougher.

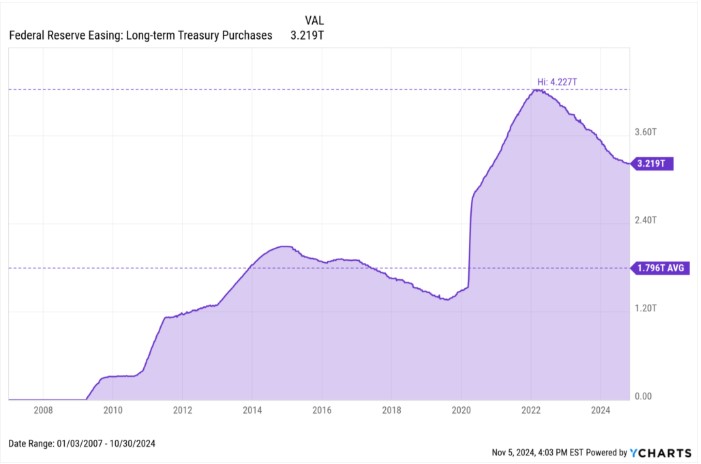

A bigger but quieter tell is that major banks and lenders are pouring money into long-term Treasuries and bonds, which has a direct, positive impact on rates.

They’re effectively hedging for lower long-term mortgage rates, knowing that as rates fall, their Treasury and bond holdings become more valuable over time.

When someone asks where I think interest rates are headed, it’s never a simple answer there are hundreds of data points to consider.

Bottom line: rates are going to drop.

When and by how much? No one can say for sure but the writing is definitely on the wall.

http://www.YourApplicationOnline.com