Inflation may be the Federal Reserve’s primary mandate, but with the labor market struggling, jobs have become the dominant concern.

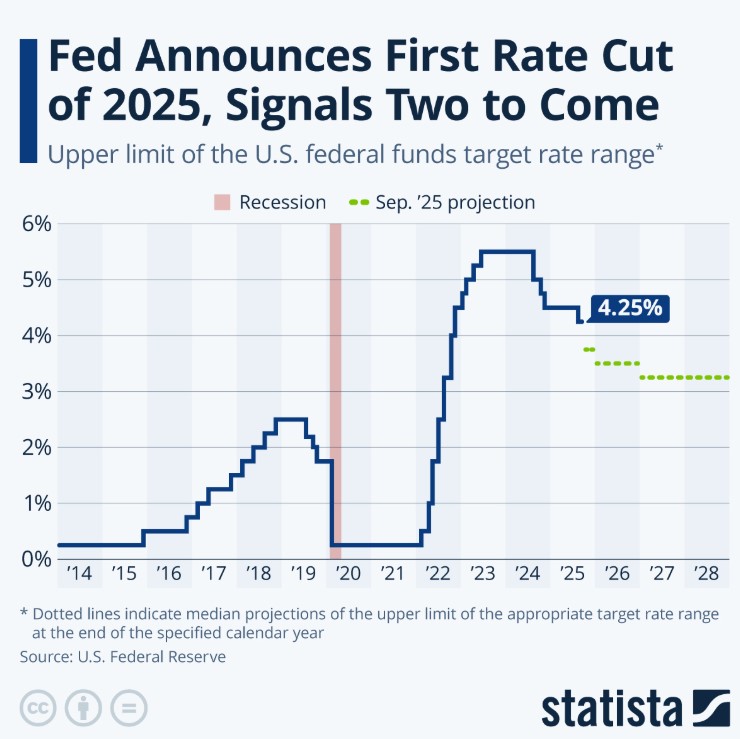

Markets are betting 65–70% on a December rate cut. When the government reopens and data starts rolling in again, signs of a softening job market could push the Fed toward a more decisive cut.

Cotality Home Price Insights show a 0.2% decline in September but still up 1.2% year over year. They forecast a 4.1% rise in the next 12 months.

If you or your client purchased a $500,000 home today, that could translate to a $20,000 increase in value over the next 12 months.

ADP, which operates independently of the government shutdown, will release its employment report tomorrow morning. Expectations are for a very weak 24,000 jobs added in October, typically, we see numbers closer to ten times that amount.

My take: Rates appear to be moving in the right direction. Out in the field, agents are reporting more activity, greater buyer interest, and a noticeable uptick in open houses.

Lets get you pre-qualified today. http://www.YourApplicationOnline.com