Day 34 of the Government Shutdown

Tomorrow marks an unfortunate record. Beyond the layoffs and furloughs, there’s a growing concern around the Worker Adjustment and Retraining Notification Act (WARN)—a federal law that protects workers, families, and communities by requiring employers with 100 or more employees to provide at least 60 calendar days’ advance written notice of a plant closing or mass layoff affecting 50 or more employees.

We are now seeing layoff levels not experienced since 2009, underscoring the deepening economic strain caused by the prolonged shutdown.

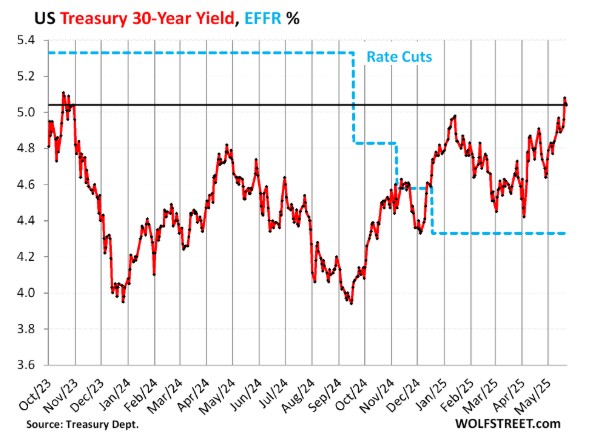

The side effect of a weakening job market is the flight to safety investors moving money out of riskier assets and into the bond and Treasury markets. As more money is “dumped” into these safe havens, demand rises, bond prices increase, and yields (interest rates) fall.

Class Dismissed and have a great rest of your week.

Let’s get you pre-approved and ready to purchase or refinance. Soft credit pull http://www.YourApplicationOnline.com