Fed Day: All Eyes on Powell

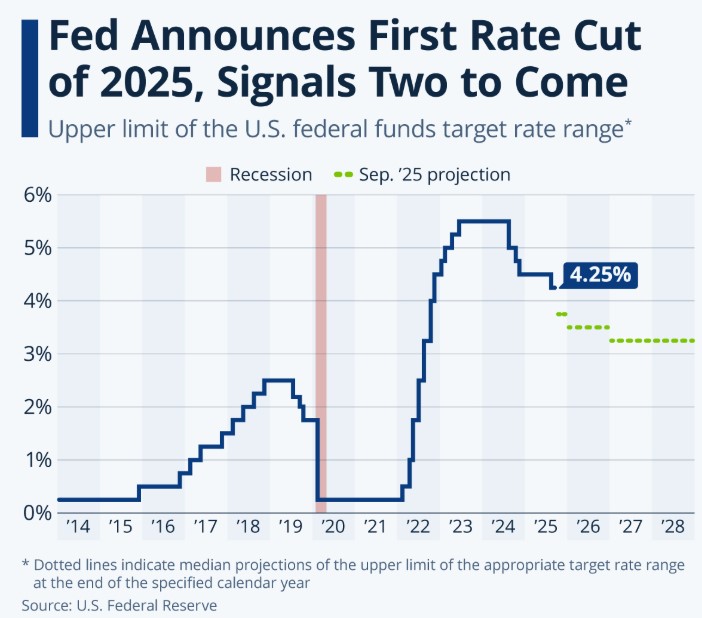

The Fed is expected to cut rates by 25 basis points this morning, but the real story will come after the 11 a.m. announcement when Chair Powell speaks. He’s been known to take a bit of a “Debbie Downer” tone, so we’re on edge and ready to lock in our clients as soon as he starts talking just in case.

The Fed also announced plans to end its runoff of Treasuries in the coming months and begin purchasing Treasuries again in 2026 very good news for long-term rates. For perspective, the Fed was buying tens of billions of dollars per month in Treasuries in 2020, totaling over $2 trillion that year. Those massive purchases were a big reason rates were so low at the time.

Mortgage applications are up, though not as much as expected. The market has largely priced in today’s rate cut and the one anticipated for December, so we don’t expect major rate drops for the remainder of the year but of course, that could change.

My take: If you’re thinking about refinancing, today’s rates are worth locking in.

http://www.YourApplicationOnline.com