Builders are skittish by nature, so when they start showing more confidence, it’s worth paying attention. They’re working with inventory that can take a year or more to bring to market, especially when new infrastructure is needed before construction even begins.

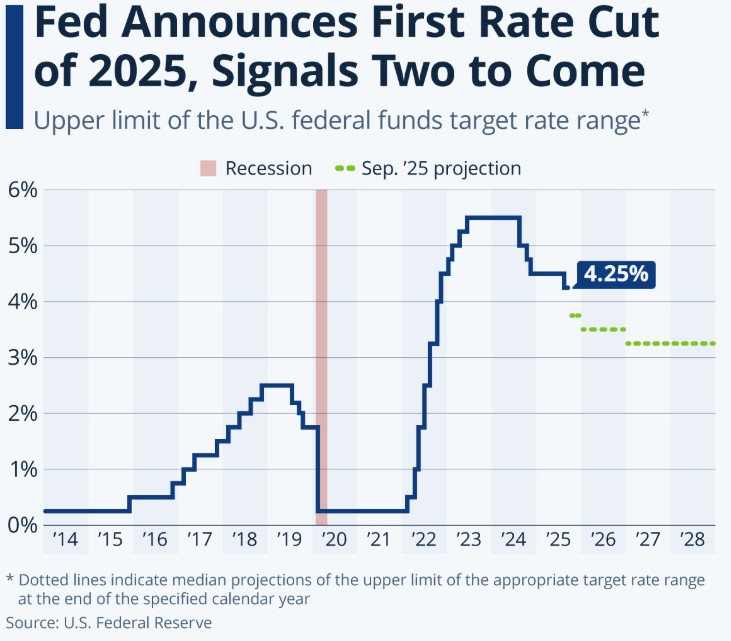

There’s now a 97% probability the Fed will lower rates by 0.25% at their October 29th meeting. The market has largely priced this in, but we’re hopeful it sets the stage for further mortgage rate improvements ahead.

My take: With the government shutdown, we’re flying blind on employment data. However, with Fed members acknowledging a weakening labor market, unemployment could rise quickly, which, fortunately or unfortunately, tends to help rates.

Lets get you pre-qualified today. http://www.YourApplicationOnline.com