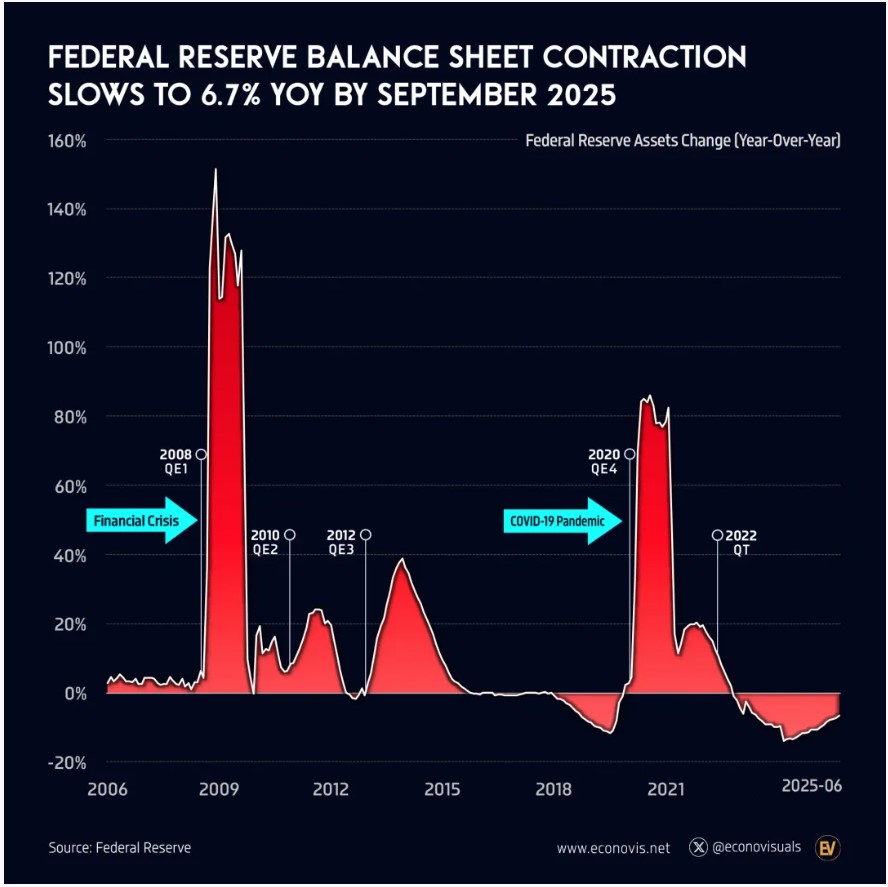

Fed Chair Powell made an interesting comment yesterday about the Fed’s balance sheet. Over the past few years, the Fed has been reducing its holdings selling off assets instead of buying bonds, which has contributed to higher rates.

The Fed now appears to be signaling a shift, potentially resuming bond purchases to support liquidity, echoing the stimulus-driven strategies seen in 2020 and post-2008.

This shift should have a positive impact on rates, with the Fed potentially investing around $20 billion per month in Treasury purchases. Powell also signaled more confidence that the recent tariff-driven inflation is temporary.

My take: I’m already seeing more applications come across our desk, not just for refinances, but also for new purchases. Competition is heating up, so if you’re thinking about buying or refinancing, now’s the time to get started.

http://www.YourApplicationOnline.com