The Fed Minutes give markets a peek behind the curtain.

They’re essentially the detailed notes from the Federal Reserve’s last meeting, showing not just what decisions were made, but why, including the tone of the discussion, differing opinions among members, and what data they’re most concerned about.

Even though the Minutes are released after the decision, traders, economists, and lenders comb through every word looking for clues about what’s next.

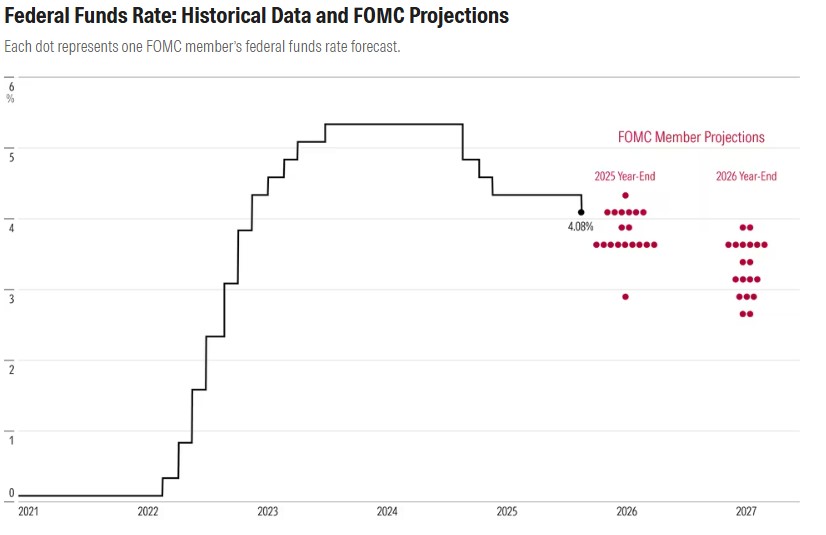

If the tone sounds more cautious or focused on inflation, markets may scale back expectations for rate cuts. If it sounds more confident about easing or mentions risks to growth, it can boost bets on future cuts.

In short:

The Fed Minutes don’t change the past, they shape expectations for the future.

Though August showed a decline in home values, the year over year values are up 1.3%.

Let’s get you pre-qualified http://www.YourApplicationOnline.com