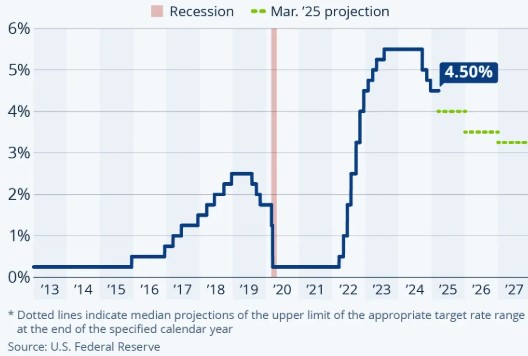

The key this afternoon isn’t just if the Fed cuts, but how. A hawkish cut, done reluctantly, with little sign of more to come, could push bonds lower and rates higher. A dovish cut, signaling openness to further easing, could lift the bond market and drive mortgage rates down.

Let’s take a quick look at what lower rates mean for real borrowers. My client purchasing a $600,000 home with 15% down was at 6.875% back in August. Today, that same loan is at 6.125%, saving about $300 per month on their mortgage payment.

So when I hear critics argue “don’t cut rates, stay the course,” I have to wonder are they thinking about the average person just trying to buy a home?

http://www.YourApplicationOnline.com