Time flies when you’re having fun, and tomorrow brings the long-awaited Fed announcement on rate cuts. The market has already priced in the expected 25bp cut, but the real story will be whether Powell signals the need for more cuts ahead.

There is a 75% chance of another 25pb cut in October with another 25bp cut in December.

The importers for now are absorbing the higher costs due to tariffs but the lingering fear is higher inflation down the road.

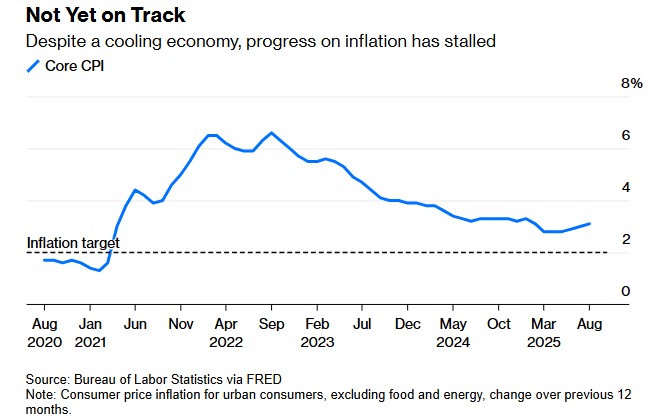

My Take: High interest rates hurt everyone. The job market has clearly cooled, yet inflation remains stubborn. Leaving the Fed rate unchanged only kicks the can further down a road we haven’t traveled in over 80 years.

Mortgage rates have been improving and should continue to trend lower for the foreseeable future, though they can always turn on a dime.

http://www.YourApplicationOnline.com