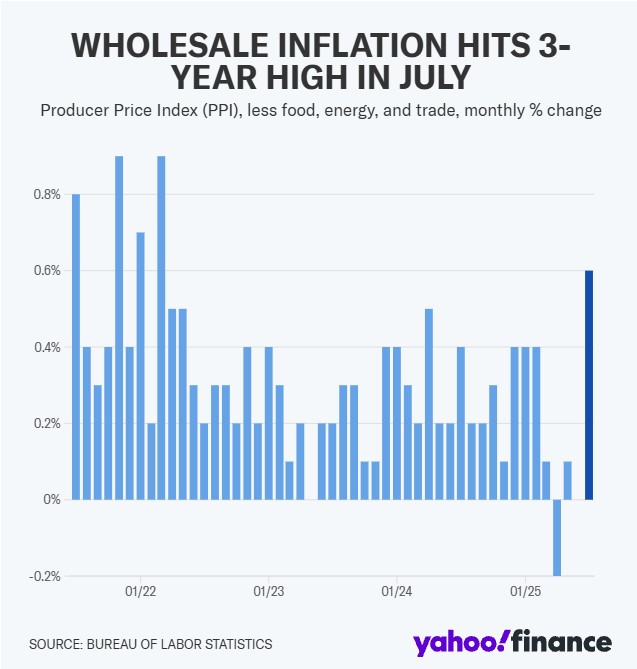

CNBC and FOX Business are buzzing about a “whopping” PPI jump but let’s unpack where that number actually came from, and why it’s showing up here before it hits the Consumer Price Index.

The last four months have been very tame for PPI and CPI even in the flood of Tariff and Tariff threats. But why? Well the ships from other countries take weeks to travel, those are not subject to new Tariffs as well as the influx of orders back in March and April to counter Tariffs.

The chickens have come home to roost — tariffs are making their way through the system exactly as expected. The Producer Price Index (PPI) measures costs at the production level, not for consumers. As these higher producer costs filter through, we can expect CPI inflation to rise in the next month or two.

How does this affect rates?

We lost some ground on interest rates today but not too much. The stock market also responded but all in all a bit muted.

Lets get you pre-qualified http://www.YourApplicationOnline.com