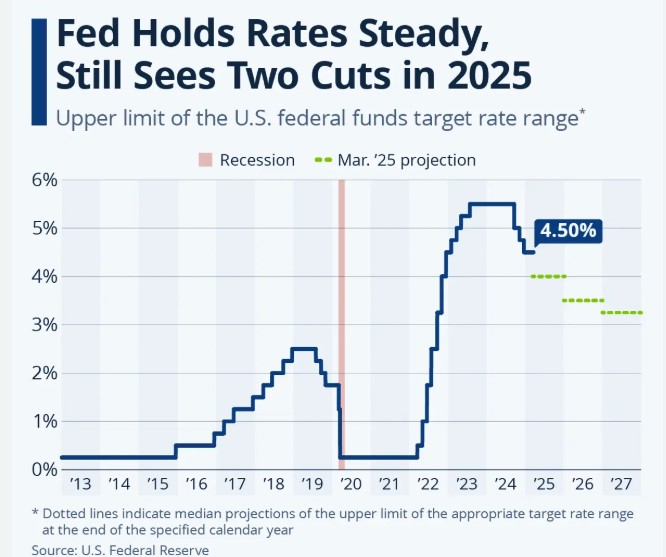

Treasury Secretary Scott Bessent suggested yesterday that the Fed should consider a 50bp “catch-up” cut, a move that would be welcome news for interest rates.

Currently, there are 11 candidates in the running for Fed Chair, with Fed Governor Chris Waller leading the pack. Waller is notably bullish on rate cuts, and we’re optimistic about what that could mean for the market.

I hopped off a webinar yesterday about the new Trigger Lead bill that just passed, set to take effect in six months. This is a big win for consumers, finally putting a stop to the barrage of unwanted calls after applying for a loan.

But what really caught my attention was the shift in energy in our industry. With rates dropping and the possibility of even deeper cuts ahead this year, there’s a new momentum building, and it’s exciting to watch.

If you haven’t already, now’s the perfect time to get financially tuned up and ready, whether you’re buying, selling, or refinancing. The shift is coming, and we want to make sure you’re ahead of the game.

http://www.YourApplicationOnline.com