Have You Been Flooded With Calls After Applying for a Mortgage?

You might be the target of a Trigger Lead.

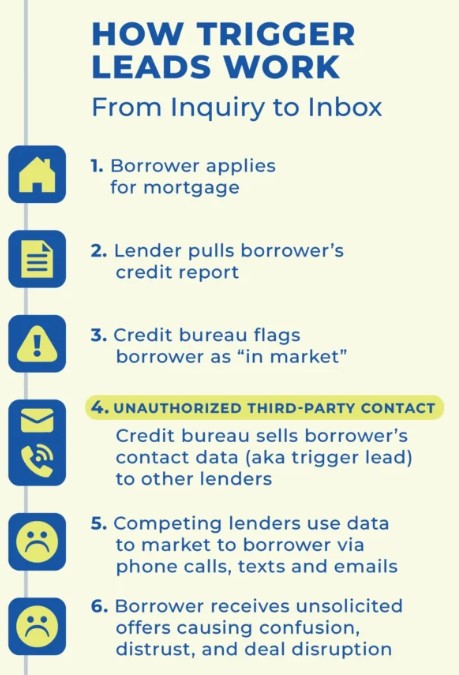

Here’s what’s happening:

When you apply for a mortgage, the three credit bureaus (Experian, Equifax, TransUnion) can sell your basic contact info to other lenders. This happens after a hard credit pull.

Some lenders buy these “trigger leads” and immediately flood you with calls, texts, and emails, sometimes within minutes.

A soft credit check helps avoid this, but eventually a hard pull is required to fully process your loan.

Why does this even exist?

It was originally meant to help consumers shop around for better loan options—but like many things, it’s now being misused.

Trigger Leads Update: Legislation Is Back on the Table

Last year, Senate Amendment 2358, which aimed to ban the sale of trigger leads, was removed at the last minute from the final legislation.

But now it’s back.

The amendment has resurfaced, and there’s renewed momentum to protect consumer information and stop the flood of unwanted calls and solicitations that happen after a mortgage credit pull.

This could be a big win for borrowers and for lenders focused on doing business the right way.

I’ll keep you posted as this moves forward.

My YouTube video below.