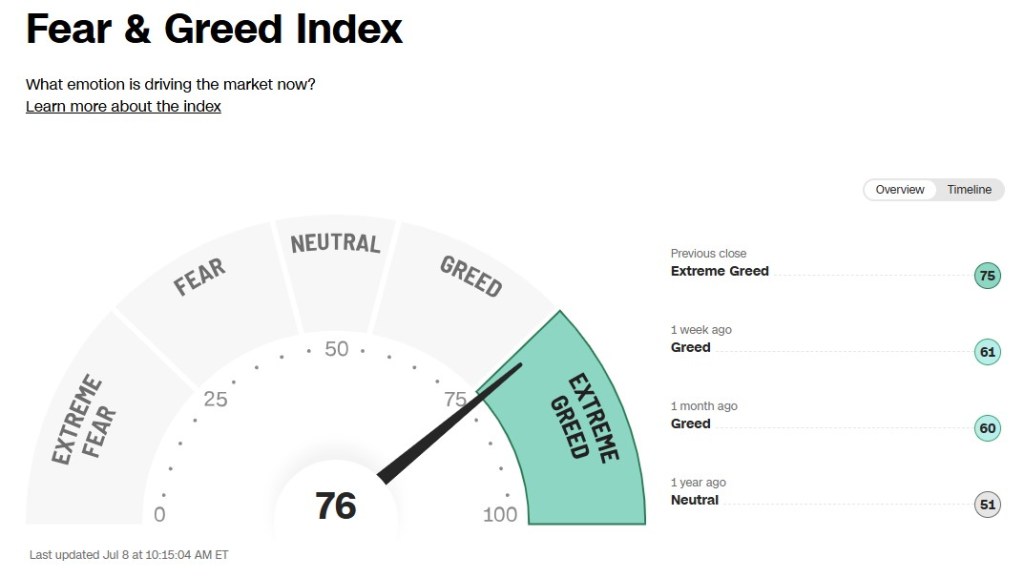

Puts and Calls options, Selling or Buying. The higher the ratio the higher the Fear and Greed. No one wants to be left with the hot potato.

Quick Market Snapshot:

Inflation? Still calm for now. Stephen Miran, Economic Chair, appeared on CNBC this morning and said inflation and tariffs are “not a thing… yet.” Translation: No immediate threat, but worth watching as policy and election dynamics evolve.

Margin debt which is money borrowed by investors to amplify gains, is now at an all-time high. While this can fuel rallies, it also means any downturn could be sharper and faster as leveraged positions unwind.

The Reserve Bank of Australia surprised markets by pausing a rate cut that had a 95% probability priced in. The signal? Central banks may not be as dovish as expected and the bond market noticed. Global yields moved higher, pressuring borrowing costs.

My Take:

Inflation is still stubborn and hanging on tighter than expected. The Fed needs to stop hesitating and start moving on a rate cut. This constant back-and-forth “we might cut, but only if…” combined with the threat of more tariffs, is creating confusion and volatility.

It’s time for consistent policy and less noise. The markets, and the economy need clarity, not more mixed signals.

http://www.YourApplicationOnline.com Soft Credit Pull