Market Update

The Federal Reserve is proposing a reduction in bank capital reserve requirements from 5% to 3.5%. While that may seem like a small shift, it could significantly impact interest rates. Why? Because it would free up billions in capital, giving banks more lending power. If approved, we could see this take effect as early as this summer.

Economic Data Highlights:

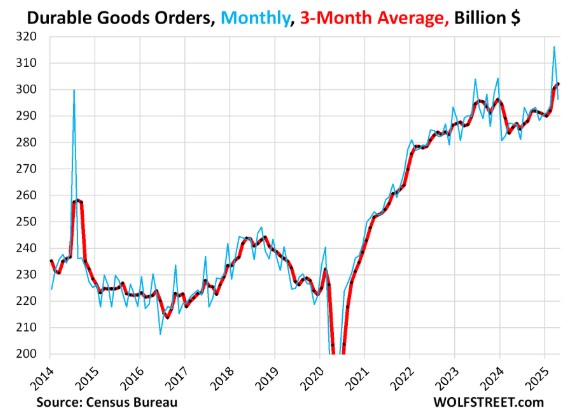

- Durable Goods Orders surged 16.4% last month nearly double the 8.5% forecast. Big-ticket items like appliances are still in demand.

- Jobs Market continues to show stress. Layoffs are rising, and it’s taking longer for people to find new employment. This has been a consistent trend in recent months and may persist.

- Pending Home Sales came in stronger than expected, up 1.8% versus a projected 0.5%.

My Take:

There’s a fundamental shift happening—not just in the economy, but in the bond market itself. This time, it feels real. Palpable.

Let’s get you ready. Soft Credit Pull http://www.YourApplicationOnline.com