In most global conflicts, stocks drop and investors rush to the safety of bonds. This time, the stock selloff happened — but the bond rally didn’t show up like it usually does.

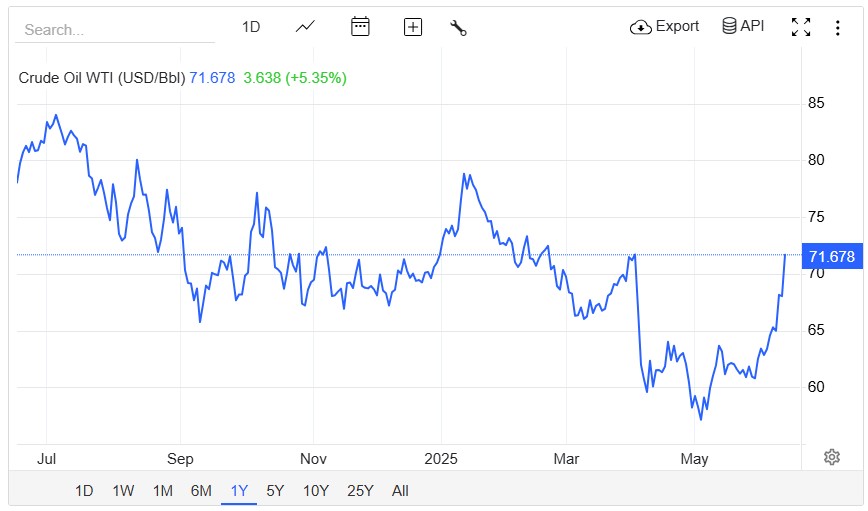

Oil prices surged 8% overnight and are up 16% over the past week.

Since oil is a major input in both the Consumer Price Index (CPI) and the Producer Price Index (PPI), this sharp increase has put inflation fears back in the spotlight.

Rising energy costs can ripple through the economy — from transportation to goods and services — making inflation harder to contain.

We saw a 30-year Treasury bond auction yesterday, following a strong 10-year auction earlier in the week. Both were met with solid demand, particularly from foreign investors — a sharp contrast to recent media narratives suggesting a global move away from the U.S. dollar and Treasuries.

The takeaway? Stocks took a hit, but the bond market didn’t respond the way we’d expect.

Rates are flat today, though we’re expecting a more favorable shift as early as next week.

http://www.YourApplicationOnline.com Soft Credit Pull.