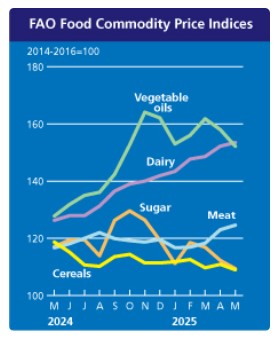

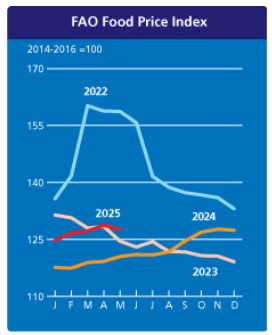

These two graphs highlight the commodity price of goods. An interesting data point.

Bonds remain on edge as trade negotiations between the US and China continue. Positive developments have sparked a rally in stocks, which is coming at the expense of bonds.

The CPI report is scheduled for release tomorrow. This marks the first month potentially affected by tariffs, though the market expects only a minimal impact.

A key point in the deregulation debate centers on the required capital ratios banks need to uphold. Treasuries are not expected to affect these ratios. Market consensus anticipates a potential drop in rates of 50 to 70 basis points—roughly equivalent to a 3/8 to 1/2 percent decline.

Almost Wednesday… YourApplicationOnline.com soft credit pull.