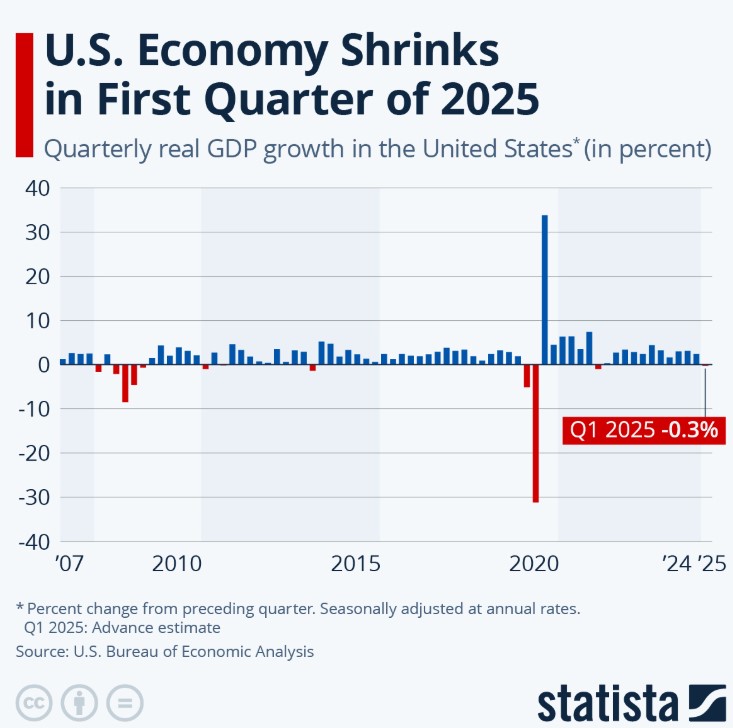

Q1 GDP came in at -0.2%, slightly better than the expected -0.3%, but still reflects a slowdown—particularly in personal spending, which rose just 1.3% compared to the 1.8% estimate.

This points to weaker consumer demand, which in turn eases pricing pressure. With fewer buyers in the market, retailers are often forced to lower prices to attract spending—ultimately helping to bring inflation down.

The power of the consumer at work.

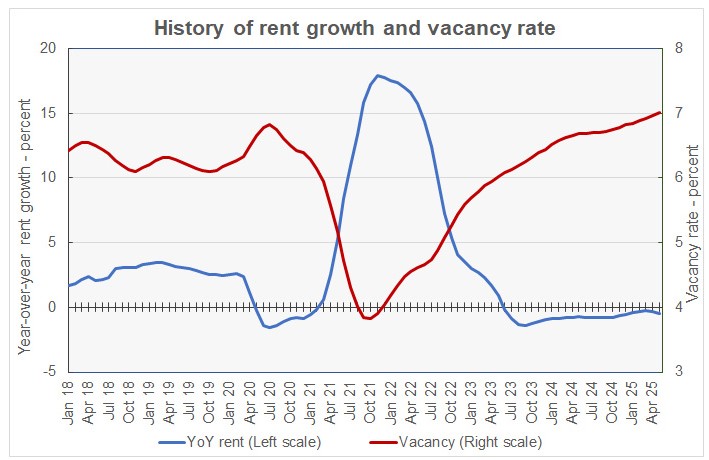

Another sign of slower consumer spending comes from the latest Apartment List Rent Report, which showed new rents rose just 0.4% in May, while rents are actually down 0.5% year-over-year.

This is especially notable because May is typically a peak season for rentals, when demand — and prices — usually trend higher.

Also worth noting: the national vacancy rate is holding at a historically low 7%, a key factor we haven’t touched on before.

The halt on Tariffs has had a positive impact not only to the stock market but the bond market as well.

http://www.YourApplicaitonOnline.com