With a new prospect of Fannie Mae and Freddie Mac exiting conservatorship and potentially going public has sparked both fear and excitement.

Lets do a quick breakdown:

Positive Impacts:

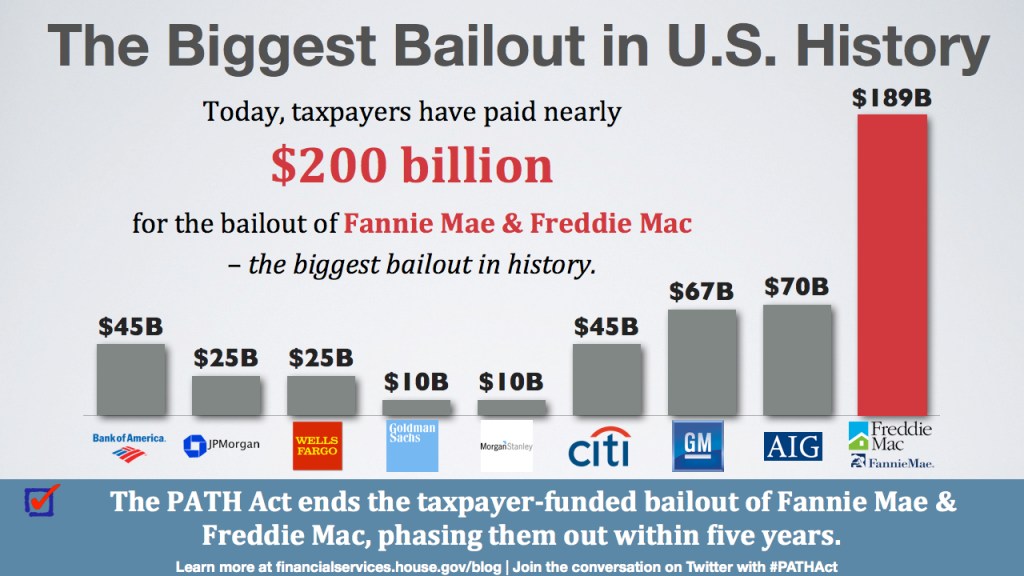

- Windfall for U.S. Government – recoup bailout funds from 2008.

- Increased Market Efficiency – market driven decision making, competition and innovation.

- Reduced Government Risk – shifting losses to private investors.

- Capital Market Benefits – raise capital and enhance their financial stability.

Negative Impacts:

- Increase in Mortgage Rates – Privatization to higher returns and higher rates.

- Reduced Access to Credit – impacts to less qualified borrowers with higher credit standards.

- Market Disruption – Government to Private is complex and disruptive.

- Financial Instability – if mismanaged could destabilize housing market.

My Take:

I lived through the 2008 financial crisis and saw firsthand both the positives and the pitfalls when Fannie and Freddie began competing with subprime lenders for market share.

It was a fun ride — until it wasn’t.

Healthy competition is a good thing, and this move has the potential to spark innovation and open up the marketplace. That said, with the government still retaining a degree of control, the guardrails remain in place — and that’s reassuring.

Soft credit pull. YourApplicationOnline.com