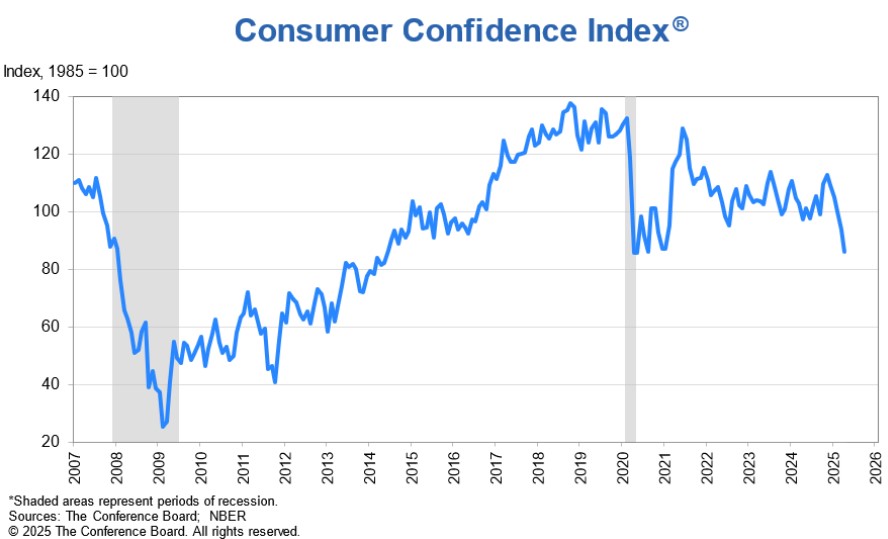

But what does this really mean? The last time we saw this level was between 2020 and 2022. This figure is heavily influenced by business conditions, employment prospects, and expectations for future income.

Historically, recessions are typically marked by readings below 80.

The March JOLTS report shows job openings declined from 7.49 million to 7.19 million, indicating clear signs of weakness in the labor market. Additionally, the quits rate — which reflects the number of people voluntarily changing jobs — remains at its lowest level since 2015.

Year-over-year, home prices have increased by 3.9%. While some regions have experienced slight declines, the overall housing market remains strong and resilient.

We anticipate continued improvement in interest rates, making this an excellent opportunity for buyers to enter the market before conditions shift.

http://www.YourApplicationOnline.com soft credit pull Nation wide.